- Home »

- Quarterly Results »

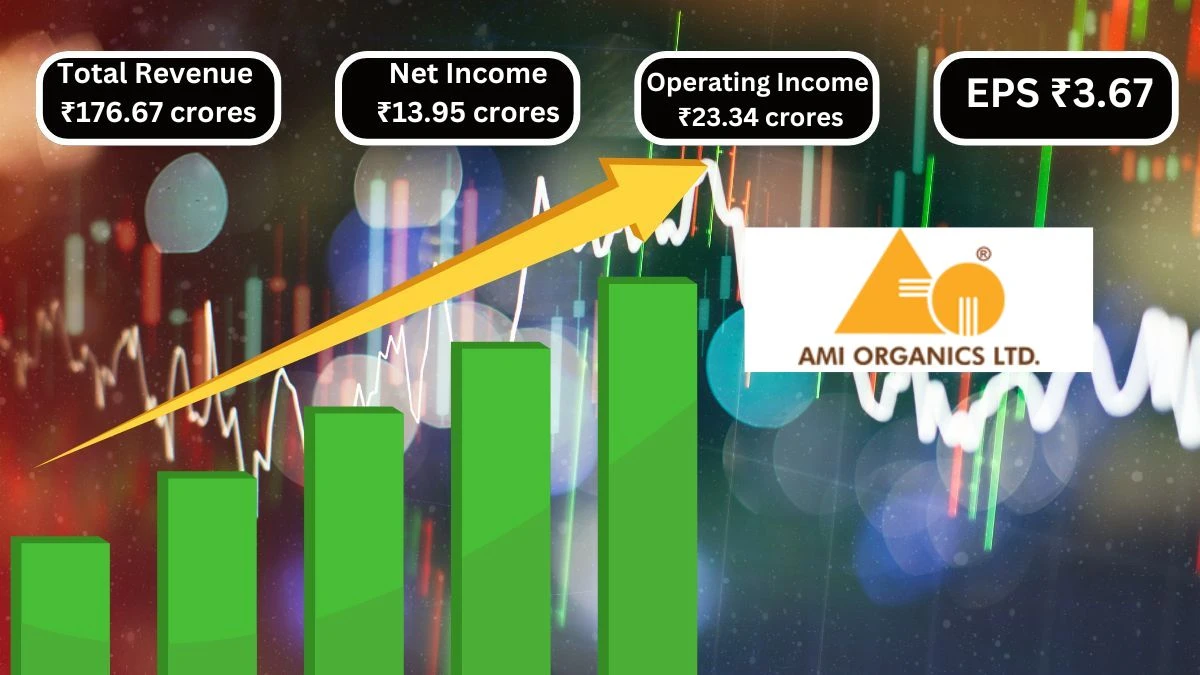

- Ami Organics Q1 Results Total Revenue of ₹176.67 crores & Net Income ₹13.95 crores

Ami Organics Q1 Results Total Revenue of ₹176.67 crores & Net Income ₹13.95 crores

Ami Organics Q1 Results with Total Revenue of ₹176.67 crores, down 21.46% from the previous quarter, and Net Income fell to ₹13.95 crores, a decrease of 44.55% QoQ.

by Ruksana

Updated Sep 23, 2024

Table of Content

Ami Organics Q1 Results: Ami Organics recently released its Q1 financial results, showing important trends in its performance. The total revenue for June 2024 was ₹176.67 crores. This is a decrease of 21.46% compared to the previous quarter (QoQ), when it was ₹186.38 crores. However, there was a year-over-year (YoY) increase of 14.93% from ₹153.72 crores in June 2023. The selling, general, and administrative expenses rose by 66.16% QoQ to ₹19.06 crores, reflecting a significant jump from ₹11.48 crores. YoY, these expenses also increased by 34.74% from ₹14.14 crores, showing that costs are rising.

Looking at net income, it was ₹13.95 crores in June 2024, a 44.55% decrease from ₹27.16 crores in the previous quarter (QoQ). This decline in net income also represents a year-over-year (YoY) drop of 29.29% from ₹19.72 crores. The diluted normalized EPS fell to ₹3.67, down 46.90% QoQ from ₹6.45 and down 39.84% YoY from ₹6.10. Overall, while Ami Organics experienced some growth YoY, the quarter-on-quarter (QoQ) results indicate challenges in maintaining profitability.

Here’s the quarterly financial results for Ami Organics for Q1:

|

Fiscal Period |

Jun 24 |

Mar 23 |

QoQ Change |

Jun 23 |

YoY Change |

|

Total Revenue |

176.67 |

186.38 |

-21.46% |

153.72 |

14.93% |

|

Selling/General/Admin Expenses |

19.06 |

11.48 |

66.16% |

14.14 |

34.74% |

|

Depreciation/Amortization |

6.18 |

3.43 |

80.51% |

3.71 |

66.51% |

|

Other Operating Expenses |

25.76 |

29.06 |

-11.39% |

25.50 |

1.05% |

|

Total Operating Expense |

153.33 |

149.05 |

2.57% |

123.42 |

24.24% |

|

Operating Income |

23.34 |

37.34 |

-38.47% |

30.29 |

-22.96% |

|

Net Income Before Taxes |

19.95 |

36.57 |

-45.36% |

30.94 |

-35.50% |

|

Net Income |

13.95 |

27.16 |

-48.72% |

19.72 |

-29.29% |

|

Diluted Normalized EPS |

3.67 |

6.45 |

-43.16% |

6.10 |

-39.84% |

Source: Here

For More Q1 Results check our Twitter Page

Visit our website for more Q1 result

Ami Organics Q1 Results

Ami Organics' standalone financial results for the quarter ending June 30, 2024, show both income and expenses for the company. In this quarter, the total income was ₹17,303.43 lakhs, which includes revenue from operations of ₹17,113.70 lakhs and other income of ₹189.73 lakhs. However, compared to the previous quarter, there was a decline in revenue, down from ₹21,993.75 lakhs.

The total expenses for the quarter were ₹15,483.31 lakhs. The largest cost came from materials consumed, totaling ₹10,464.04 lakhs. Other significant expenses included employee benefits and finance costs. The company reported a profit before tax of ₹1,820.12 lakhs for this quarter, which is lower than the previous quarter's profit of ₹4,228.74 lakhs.

After accounting for tax expenses of ₹448.53 lakhs, the profit for the period was ₹1,371.59 lakhs. This reflects a decrease compared to last year. The company's earnings per share (EPS) were ₹3.43 for basic shares and ₹3.20 for diluted shares, showing a decline from previous periods. Overall, the results indicate challenges in maintaining income levels while managing expenses, impacting profitability.

Here’s a simplified version of the standalone financial results for the period ended June 30, 2024:

(in Lakhs)

|

Particulars |

Quarter Ended |

Year Ended |

|

June 30, 2024 |

March 31, 2024 |

|

|

Income |

||

|

Revenue From Operations |

17,113.70 |

21,993.75 |

|

Other Income |

189.73 |

855.39 |

|

Total Income |

17,303.43 |

22,849.14 |

|

Expenses |

||

|

Cost of materials consumed |

10,464.04 |

13,314.94 |

|

Changes in inventories |

(381.59) |

107.74 |

|

Employee benefits expense |

1,845.64 |

1,635.98 |

|

Finance costs |

437.27 |

205.61 |

|

Depreciation and amortization expense |

562.14 |

436.31 |

|

Other expenses |

2,555.81 |

2,919.82 |

|

Total Expenses |

15,483.31 |

18,620.40 |

|

Profit/(loss) before exceptional items and tax |

1,820.12 |

4,228.74 |

|

Exceptional Items |

- |

- |

|

Profit/(loss) before tax |

1,820.12 |

4,228.74 |

|

Tax expense |

||

|

Current tax |

361.83 |

730.58 |

|

Deferred tax |

86.70 |

290.47 |

|

Total Tax expense |

448.53 |

1,020.75 |

|

Profit/(loss) for the period/year |

1,371.59 |

3,207.99 |

|

Other Comprehensive Income |

||

|

Remeasurement of defined benefit plans |

(2.31) |

7.31 |

|

Total Comprehensive Income |

1,369.28 |

3,215.30 |

|

Paid up equity share capital |

4,090.56 |

3,688.06 |

|

Other Equity |

63,823.48 |

- |

|

Earnings per share |

||

|

Basic (in ₹) |

3.43 |

8.75 |

|

Diluted (in ₹) |

3.20 |

8.74 |

Ami Organics Financial Performance

Ami Organics is a company with a market capitalization of ₹ 6,931 crores, which shows its overall value in the stock market. The current stock price is ₹ 1,694, and it has reached a high of ₹ 1,698 and a low of ₹ 1,004 in recent trading. The stock has a Price-to-Earnings (P/E) ratio of 109, indicating that investors are willing to pay a high price for its earnings. The book value is ₹ 183, which represents the value of the company’s assets. It offers a dividend yield of 0.18%, has a Return on Capital Employed (ROCE) of 16.0%, and a Return on Equity (ROE) of 9.37%.

Here’s a summary of the market cap and stock details you provided:

|

Metric |

Value |

|

Market Cap |

₹ 6,931 Cr. |

|

Current Price |

₹ 1,694 |

|

High / Low |

₹ 1,698 / ₹ 1,004 |

|

Stock P/E |

109 |

|

Book Value |

₹ 183 |

|

Dividend Yield |

0.18% |

|

ROCE |

16.0% |

|

ROE |

9.37% |

|

Face Value |

₹ 10.0 |

Quarterly Results

The table shows the financial performance of Ami Organics for three quarters: December 2023, March 2024, and June 2024. In December 2023, the company had sales of ₹166 crores and net profit of ₹18 crores. By March 2024, sales increased significantly to ₹225 crores, and net profit rose to ₹26 crores, showing strong growth.

Here's the table with data for December 2023, March 2024, and June 2024:

|

Particulars |

Dec 2023 |

Mar 2024 |

Jun 2024 |

|

Sales (Rs. Crores) |

166 |

225 |

177 |

|

Expenses (Rs. Crores) |

140 |

182 |

147 |

|

Operating Profit (Rs. Crores) |

27 |

43 |

30 |

|

OPM % |

16% |

19% |

17% |

|

Other Income (Rs. Crores) |

3 |

1 |

1 |

|

Interest (Rs. Crores) |

3 |

2 |

4 |

|

Depreciation (Rs. Crores) |

4 |

5 |

6 |

|

Profit Before Tax (Rs. Crores) |

24 |

37 |

20 |

|

Tax % |

25% |

31% |

26% |

|

Net Profit (Rs. Crores) |

18 |

26 |

15 |

|

EPS (Rs.) |

4.54 |

6.82 |

3.41 |

About Ami Organics

Ami Organics is a company founded in 2007, based in Gujarat, India. It specializes in making specialty chemicals for industries like agriculture, cosmetics, and polymers. The company started as a partnership and later became a formal company to better serve the needs of the pharmaceutical industry. Ami Organics focuses on innovation, quality, and advanced technology in its operations.

The team at Ami Organics is made up of experienced professionals who use modern production lines and testing facilities to create a wide range of products. They offer custom synthesis and contract manufacturing services to meet the specific needs of their clients. The company is committed to meeting strict regulatory standards and ensuring safety and quality in its products.

Ami Organics aims to grow its presence in the international market, serving over 27 countries, including North America, Europe, and Asia. Recently, the company expanded by acquiring two manufacturing facilities to enhance its production capabilities. With certifications like ISO 9001:2015 and USFDA approval, Ami Organics is dedicated to providing high-quality chemicals and pharmaceutical intermediates to support healthcare globally.

Ami Organics Q1 Results - FAQs

1. What is Ami Organics' total revenue for Q1 2024?

Ami Organics reported a total revenue of ₹176.67 crores for Q1 2024.

2. How much did Ami Organics' net income decrease in Q1 2024?

Ami Organics' net income decreased by 48.72% in Q1 2024.

3. What were the selling, general, and administrative expenses for Ami Organics in Q1 2024?

Ami Organics had selling, general, and administrative expenses of ₹19.06 crores in Q1 2024.

4. Did Ami Organics experience year-over-year growth in revenue?

Yes, Ami Organics experienced a 14.93% increase in revenue year-over-year.

5. How much did Ami Organics spend on total operating expenses in Q1 2024?

Ami Organics spent ₹153.33 crores on total operating expenses in Q1 2024.

6. What was the profit before tax for Ami Organics in Q1 2024?

Ami Organics reported a profit before tax of ₹1,820.12 lakhs in Q1 2024.

7. What is the market capitalization of Ami Organics?

The market capitalization of Ami Organics is ₹6,931 crores.

8. What was Ami Organics' current stock price?

The current stock price of Ami Organics is ₹1,694.

9. How does Ami Organics' P/E ratio compare to industry standards?

Ami Organics has a P/E ratio of 109, indicating high investor valuation.

10. What were Ami Organics' total expenses in Q1 2024?

Ami Organics' total expenses in Q1 2024 were ₹15,483.31 lakhs.