- Home »

- Quarterly Results »

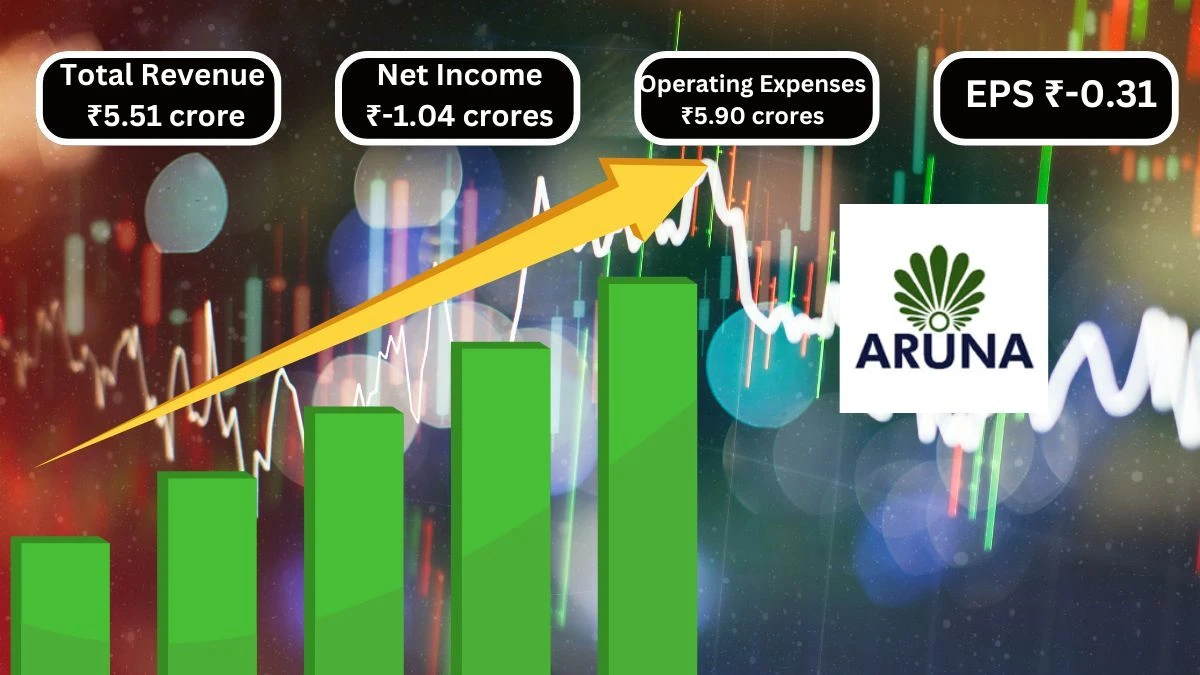

- Aruna Hotels Q1 Results Total Revenue of ₹5.51 crores & Net Income ₹-1.04 crores

Aruna Hotels Q1 Results Total Revenue of ₹5.51 crores & Net Income ₹-1.04 crores

Aruna Hotels Q1 Results showing Total Revenue of ₹5.51 crores, an 84.87% YoY increase and Net Income improved to ₹-1.04 crores, up 102.60% YoY.

by Ruksana

Updated Sep 23, 2024

Table of Content

Aruna Hotels Q1 Results: Aruna Hotels has shared its Q1 results for June 2024, and the data shows some interesting trends. In this quarter, the total revenue was ₹5.51 crores, which is an increase of 84.87% YoY compared to ₹2.98 crores in June 2023. However, when looking at the QoQ performance, the revenue decreased by 11.27% from ₹1.58 crores in March 2023. This indicates that while the hotel is doing better compared to last year, it faced a dip in revenue from the previous quarter.

Aruna Hotels’ net income also improved, showing a significant change of 102.60% YoY as it rose from ₹-1.47 crores in June 2023 to -1.04 crores this year. This shows that the hotel is reducing its losses compared to last year. However, the QoQ results show that net income decreased from ₹-2.98 crores in March 2023, showing improvement from the last quarter.

Aruna Hotels’ Other expenses, like selling and general expenses, fell by 68.53% YoY to ₹0.24 crores, while total operating expenses decreased by 66.15% YoY, showing the hotel is managing its costs better. Overall, while there are positive signs year-over-year, the hotel is still working through some challenges quarter-on-quarter.

Here's a summary of Aruna Hotels' Q1 results with all figures in crores:

|

Fiscal Period |

Jun 24 |

Mar 23 |

QoQ Change |

Jun 23 |

YoY Change |

|

Total Revenue |

5.51 |

1.58 |

-11.27% |

2.98 |

84.87% |

|

Selling/General/Admin Expenses |

0.24 |

0.27 |

-9.26% |

0.77 |

-68.53% |

|

Depreciation/Amortization |

0.87 |

0.94 |

0.21% |

0.83 |

5.16% |

|

Other Operating Expenses |

3.68 |

18.76 |

-10.92% |

1.39 |

163.76% |

|

Total Operating Expense |

5.90 |

20.13 |

-8.53% |

3.55 |

66.15% |

|

Operating Income |

-0.40 |

-18.55 |

59.93% |

-0.57 |

-30.98% |

|

Net Income Before Taxes |

-0.78 |

-5.98 |

2.12% |

-1.14 |

-31.44% |

|

Net Income |

-1.04 |

-2.98 |

102.60% |

-1.47 |

-29.40% |

|

Diluted Normalized EPS |

-0.31 |

-0.88 |

106.67% |

-0.43 |

-27.91% |

Source: Here

For More Q1 Results check our Twitter Page

Visit our website for more Q1 result

Aruna Hotels Q1 Results

Aruna Hotels’ financial results show the company's performance over different periods. In the quarter ending June 30, 2024, the hotel earned ₹550.66 lakhs from its operations. This was a decrease compared to the previous year, where the total revenue was ₹620.57 lakhs. The hotel also earned ₹2.54 lakhs in other income, bringing the total income to ₹553.20 lakhs. However, the total expenses were ₹631.06 lakhs, which includes costs like materials, employee salaries, and depreciation. This resulted in a loss of ₹77.86 lakhs before taxes.

After accounting for taxes, including deferred tax, the net loss was ₹103.63 lakhs. This was worse than the loss of ₹51.15 lakhs in the previous year. The hotel’s total comprehensive income, which considers all income and expenses, was also negative at ₹103.63 lakhs. The earnings per share were negative, meaning each share lost value, with a basic and diluted loss of ₹0.31 per share. The paid-up capital remained constant at ₹3,390 lakhs. Overall, the financial results indicate that Aruna Hotels faced challenges in maintaining profitability during this period, reflecting a tough market environment.

Here’s a summary of the financial results formatted in a clear table:

|

Particulars |

Quarter Ended 30.06.2024 (Rs. In Lakhs) (Unaudited) |

Year Ended 31.03.2024 (Rs. In Lakhs) Audited |

Year Ended 30.06.2023 (Rs. In Lakhs) |

Year Ended 31.03.2024 (Rs. In Lakhs) Audited |

|

(I) Revenue from Operations |

550.66 |

620.57 |

297.86 |

1,731.94 |

|

(II) Other Income |

2.54 |

1,228.02 |

297.86 |

1,228.21 |

|

(III) Total Income (I+II) |

553.20 |

1,848.59 |

595.72 |

2,960.15 |

|

(IV) Expenses |

||||

|

(a) Cost Materials Consumed |

111.12 |

118.80 |

56.06 |

318.79 |

|

(b) Purchase of stock-in-trade |

||||

|

(c) Changes in Inventories |

||||

|

(d) Employee benefits expense |

24.21 |

26.68 |

76.92 |

216.64 |

|

(e) Finance Cost |

||||

|

(f) Depreciation and amortisation expense |

40.77 |

1,279.48 |

56.14 |

1,437.35 |

|

(g) Other Expense |

87.10 |

86.92 |

82.83 |

340.31 |

|

Total Expenses (IV) |

631.06 |

1,924.83 |

411.42 |

3,333.96 |

|

(V) Profit/(Loss) before Exceptional Items and Tax (III-IV) |

-77.86 |

-76.24 |

-113.56 |

-373.81 |

|

(VI) Exceptional items |

||||

|

(VII) Profit/(Loss) Before Tax (V-VI) |

-77.86 |

-76.24 |

-113.56 |

-373.81 |

|

(VIII) Tax Expense |

||||

|

Current Tax |

||||

|

Deferred Tax |

25.77 |

-25.09 |

33.23 |

76.00 |

|

(IX) Net profit/(Loss) for the period from Continuing Operations after tax (VII-VIII) |

-103.63 |

-51.15 |

-146.79 |

-449.81 |

|

(X) Profit/(Loss) from discontinued operations before tax |

||||

|

(XI) Tax Expense of discontinued Operations |

||||

|

(XII) Profit (Loss) from discontinued Operations after tax (X-XI) |

||||

|

(XIII) Profit/(Loss) for the Period |

-103.63 |

-51.15 |

-146.79 |

-449.81 |

|

(XIV) Other Comprehensive Income |

3.82 |

|||

|

(XV) Total Comprehensive Income for the period |

-103.63 |

-47.33 |

-146.79 |

-445.99 |

|

(XVI) Paid-Up Equity Share Capital (Face Value of Rs 10 each) |

3,390.00 |

3,390.00 |

3,390.00 |

3,390.00 |

|

(XVII) Earnings Per Equity Share (for Continuing Operations) |

||||

|

Nominal Value of share (Rs) |

10.00 |

10.00 |

10.00 |

10.00 |

|

(a) Basic |

-0.31 |

-0.15 |

-0.43 |

-1.33 |

|

(b) Diluted |

-0.31 |

-0.15 |

-0.43 |

-1.33 |

|

(XIX) Earnings per Equity Share (for discontinued Operations) |

||||

|

(a) Basic |

||||

|

(b) Diluted |

Aruna Hotels Financial Performance

Aruna Hotels is a company with specific financial details that help investors understand its performance. The market cap, or the total value of the company, is ₹ 41.3 Crores, indicating its size. The current stock price is ₹ 12.2, which shows how much one share costs right now. The stock has reached a high of ₹ 23.4 and a low of ₹ 9.47 over a certain period. The book value of ₹ 7.84 reflects the company's assets minus its liabilities.

Here’s the financial information presented in a table format:

|

Metric |

Value |

|

Market Cap |

₹ 41.3 Cr |

|

Current Price |

₹ 12.2 |

|

High / Low |

₹ 23.4 / ₹ 9.47 |

|

Stock P/E |

- |

|

Book Value |

₹ 7.84 |

|

Dividend Yield |

0.00 % |

|

ROCE |

6.99 % |

|

ROE |

-15.6 % |

|

Face Value |

₹ 10.0 |

Quarterly Results

The table for Aruna Hotels shows its financial performance for the quarters ending in December 2023, March 2024, and June 2024. In December 2023, the hotel had sales of ₹3.87 crores, with expenses slightly higher at ₹3.68 crores, resulting in a small operating profit of ₹0.19 crores. By March 2024, sales increased to ₹6.21 crores, and expenses also rose to ₹5.59 crores, leading to a higher operating profit of ₹0.62 crores.

Here's the table for the quarters Dec 2023, Mar 2024, and Jun 2024:

Figures in Rs. Crores

|

Particulars |

Dec 2023 |

Mar 2024 |

Jun 2024 |

|

Sales |

3.87 |

6.21 |

5.51 |

|

Expenses |

3.68 |

5.59 |

5.04 |

|

Operating Profit |

0.19 |

0.62 |

0.47 |

|

OPM % |

4.91% |

9.98% |

8.53% |

|

Other Income |

0.00 |

12.28 |

0.03 |

|

Interest |

0.43 |

12.79 |

0.41 |

|

Depreciation |

0.86 |

0.87 |

0.87 |

|

Profit Before Tax |

-1.10 |

-0.76 |

-0.78 |

|

Tax % |

33.33% |

-32.89% |

33.33% |

|

Net Profit |

-1.58 |

-0.51 |

-1.04 |

|

EPS in Rs |

-0.47 |

-0.15 |

-0.31 |

About Aruna Hotels

Aruna Hotels is a well-known hotel group based in India, recognized for providing excellent hospitality and comfortable accommodations. The group operates several hotels, including the Pharos Hotel, which is located in the bustling area of Nungambakkam. Aruna Hotels aims to offer a welcoming atmosphere for both business and leisure travelers. They focus on high-quality service, making sure guests feel at home during their stay. Each hotel in the Aruna group is designed with modern facilities and unique features to cater to different needs.

Guests can enjoy various amenities, such as restaurants, fitness centers, and spas. The staff is trained to provide friendly and efficient service, ensuring a pleasant experience for all visitors. Aruna Hotels also values customer feedback and continuously works to improve their services. Overall, Aruna Hotels is committed to creating memorable experiences for their guests, making them a preferred choice for travelers in the region.

Aruna Hotels Q1 Results - FAQs

1. What is the total revenue for Aruna Hotels in Q1 2024?

Aruna Hotels reported a total revenue of ₹5.51 crores in Q1 2024.

2. How much did Aruna Hotels improve its revenue year-over-year?

Aruna Hotels saw an increase of 84.87% in revenue compared to June 2023.

3. What was the net income for Aruna Hotels in Q1 2024?

Aruna Hotels reported a net loss of ₹1.04 crores in Q1 2024.

4. Did Aruna Hotels experience any changes in operating expenses?

Yes, Aruna Hotels reduced its total operating expenses by 66.15% YoY.

5. How much did Aruna Hotels’ net income improve compared to last year?

Aruna Hotels’ net income improved by 102.60% compared to June 2023.

6. What were the total comprehensive losses for Aruna Hotels?

Aruna Hotels reported total comprehensive losses of ₹103.63 lakhs.

7. How did Aruna Hotels manage its selling and general expenses?

Aruna Hotels reduced selling and general expenses by 68.53% YoY.

8. What is the market cap of Aruna Hotels?

The market cap of Aruna Hotels is ₹41.3 crores.

9. What was the sales performance of Aruna Hotels in December 2023?

Aruna Hotels recorded sales of ₹3.87 crores in December 2023.

10. What were the total expenses for Aruna Hotels in Q1 2024?

Aruna Hotels' total expenses in Q1 2024 were ₹631.06 lakhs.