- Home »

- Quarterly Results »

- Bajaj Auto Q1 Results Total Operating Expenses Rise to ₹9,656.64 Crores

Bajaj Auto Q1 Results Total Operating Expenses Rise to ₹9,656.64 Crores

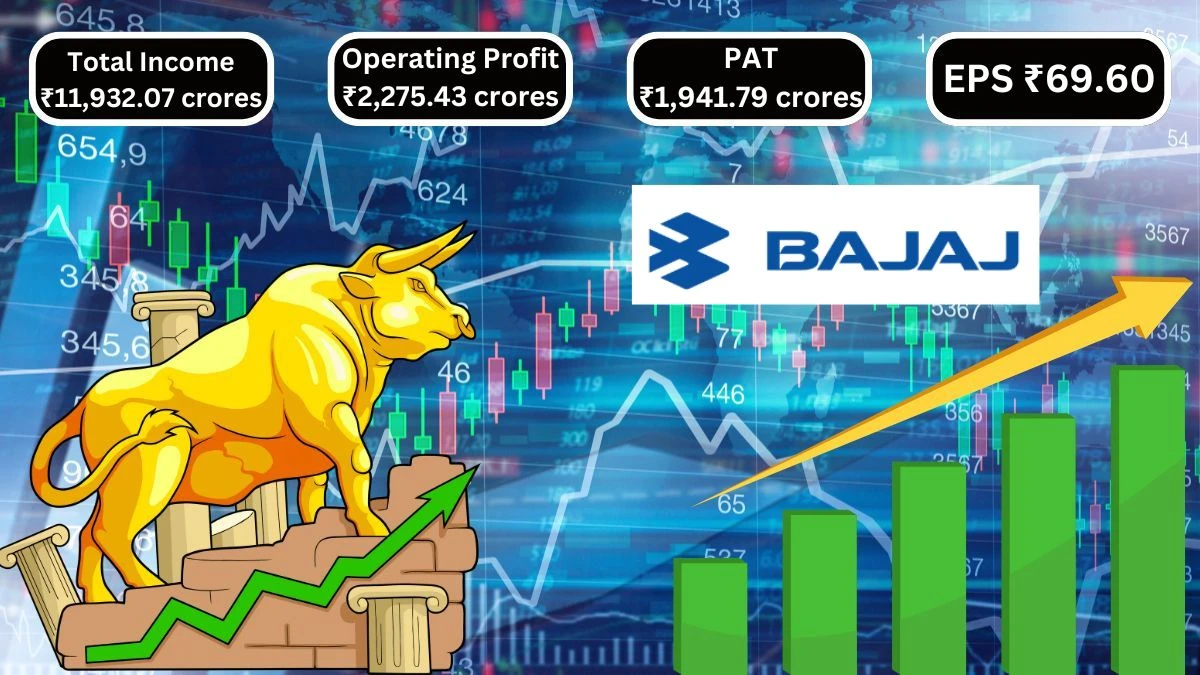

Bajaj Auto Q1 Results show a Total Income of ₹11,932.07 crores and they achieved an Operating Profit of ₹2,275.43 crores and a Profit After Tax of ₹1,941.79 crores.

by Ruksana

Updated Oct 01, 2024

Table of Content

Bajaj Auto Q1 Results Comparison

Bajaj Auto Q1 Results: Bajaj Auto's financial results for Q1 of June 2024 show strong growth when compared year-over-year (YoY) and quarter-on-quarter (QoQ). The total revenue for this quarter was ₹11,932.07 crores, a noticeable rise from ₹8,929.23 crores in the previous quarter (March 2023), and a clear improvement from ₹10,311.91 crores year-over-year (YoY). This means the company earned more quarter-on-quarter (QoQ) than the same period last year.

Bajaj Auto expenses, Selling, General, and Administrative expenses increased to ₹491.81 crores, up from ₹379.51 crores last quarter and ₹401.35 crores YoY. This rise shows that Bajaj Auto spent more on running its operations compared to the same period last year (YoY). Depreciation and amortization, or the cost of maintaining assets, also went up to ₹95.01 crores, higher than both last quarter and year-over-year (YoY) when it was ₹87.23 crores.

Bajaj Auto’s Operating income, or profit from core operations, increased to ₹2,275.43 crores from ₹1,581.22 crores last quarter and ₹1,845.04 crores YoY. The company’s net income also saw growth, reaching ₹1,941.79 crores, compared to ₹1,644.14 crores YoY. This indicates that Bajaj Auto is becoming more profitable both on a quarterly and year-over-year (YoY) basis.

Here are the Bajaj Auto Q1 Results for June 2024, compared to March 2023 (quarter-on-quarter, QoQ) and June 2023 (year-on-year, YoY):

|

Metric |

Jun 2024 |

Mar 2023 |

QoQ Comp (%) |

Jun 2023 |

YoY Comp (%) |

|

Total Revenue |

₹11,932.07 Cr |

₹8,929.23 Cr |

- |

₹10,311.91 Cr |

- |

|

Selling/General/Admin Expenses |

₹491.81 Cr |

₹379.51 Cr |

- |

₹401.35 Cr |

- |

|

Depreciation/Amortization |

₹95.01 Cr |

₹75.99 Cr |

- |

₹87.23 Cr |

- |

|

Other Operating Expenses |

₹774.92 Cr |

₹625.38 Cr |

- |

₹560.10 Cr |

- |

|

Total Operating Expense |

₹9,656.64 Cr |

₹7,348.01 Cr |

- |

₹8,466.87 Cr |

- |

|

Operating Income |

₹2,275.43 Cr |

₹1,581.22 Cr |

- |

₹1,845.04 Cr |

- |

|

Net Income Before Taxes |

₹2,563.78 Cr |

₹2,160.11 Cr |

- |

₹2,184.05 Cr |

- |

|

Net Income |

₹1,941.79 Cr |

₹1,704.74 Cr |

- |

₹1,644.14 Cr |

- |

|

Diluted Normalized EPS |

₹69.60 |

₹60.26 |

- |

₹58.10 |

- |

Source: Here

For More Q1 Results check our Twitter Page

Visit our website for more Q1 results

Bajaj Auto Q1 Results

Bajaj Auto’s financial results for the quarter ending June 30, 2024, show strong performance across various metrics. The company's total revenue from operations for this period was ₹11,928.02 crore, which is higher than the ₹11,484.68 crore from the previous quarter (March 2024). It also increased from ₹10,309.77 crore in the same quarter last year (June 2023). This rise in revenue reflects growing demand and better sales.

Bajaj Auto’s other income was ₹320.94 crore, making the total income for the quarter ₹12,248.96 crore, up from the previous quarter's ₹11,833.34 crore. The net profit (profit after tax) was ₹1,988.34 crore, showing improvement over the ₹1,936 crore in the previous quarter and ₹1,664.77 crore in the same quarter last year.

Expenses also increased, with Bajaj Auto spending ₹9,627.12 crore in total. A large portion of this went to raw materials and components, which cost ₹7,516.60 crore. Despite higher expenses, Bajaj Auto managed to achieve a profit before tax of ₹2,621.84 crore.

Bajaj Auto’s earnings per share (EPS), which shows how much profit each share made, increased to ₹71.2 compared to ₹58.9 in June 2023, showing a positive trend for shareholders.

Here's a summary of the standalone unaudited financial results for the quarter ending June 30, 2024, based on the data provided:

(in ₹ Crores)

|

Particulars |

Q1 FY24 (30.06.2024) |

Q4 FY23 (31.03.2024) |

Q1 FY23 (30.06.2023) |

FY23 Total (31.03.2024) |

|

Sales (Numbers) |

1,102,056 |

1,062,426 |

1,027,091 |

4,337,466 |

|

Revenue from Operations |

₹11,928.02 |

₹11,484.68 |

₹10,309.77 |

₹44,685.23 |

|

Other Income |

₹320.94 |

₹348.66 |

₹346.33 |

₹1,402.45 |

|

Total Income |

₹12,248.96 |

₹11,833.34 |

₹10,656.10 |

₹46,087.68 |

|

Expenses |

₹9,627.12 |

₹9,291.77 |

₹8,451.46 |

₹36,265.67 |

|

Profit Before Tax |

₹2,621.84 |

₹2,541.57 |

₹2,204.64 |

₹9,822.01 |

|

Tax Expense |

₹633.50 |

₹605.57 |

₹539.87 |

₹2,343.22 |

|

Net Profit |

₹1,988.34 |

₹1,936.00 |

₹1,664.77 |

₹7,478.79 |

|

Other Comprehensive Income |

₹81.40 |

₹223.14 |

₹336.55 |

₹765.13 |

|

Total Comprehensive Income |

₹2,069.74 |

₹2,159.14 |

₹2,001.32 |

₹8,243.92 |

|

Equity Share Capital |

₹279.18 |

₹279.18 |

₹282.96 |

₹279.18 |

|

Basic & Diluted Earnings per Share (EPS) (₹) |

71.2 |

68.5 |

58.9 |

264.6 |

Bajaj Auto Stock Metrics

The Bajaj Auto table shows important financial information about the company. Its market capitalization is ₹ 3,42,286 Cr., meaning this is the total value of all its shares. The current stock price is ₹ 12,257, with a high of ₹ 12,774 and a low of ₹ 4,903 over a certain period, indicating its price fluctuations. The Price-to-Earnings (P/E) ratio is 42.7, showing how much investors pay for each rupee of profit. The book value is ₹ 1,037, reflecting the company's asset value. The dividend yield of 0.66% means investors earn this percentage from dividends.

Here’s the information presented in a table format:

|

Financial Metric |

Value |

|

Market Cap |

₹ 3,42,286 Cr. |

|

Current Price |

₹ 12,257 |

|

High / Low |

₹ 12,774 / ₹ 4,903 |

|

Stock P/E |

42.7 |

|

Book Value |

₹ 1,037 |

|

Dividend Yield |

0.66% |

|

ROCE |

33.5% |

|

ROE |

26.5% |

|

Face Value |

₹ 10.0 |

Quarterly Results

The Bajaj Auto financial results for December 2023, March 2024, and June 2024 show important trends in the company's performance. In December 2023, Bajaj Auto had sales of ₹12,165 crores and a net profit of ₹2,033 crores. By March 2024, sales decreased to ₹11,555 crores, and net profit slightly dropped to ₹2,011 crores. In June 2024, sales increased to ₹11,932 crores, but net profit fell further to ₹1,942 crores.

Here’s the summary of the financial results for Dec 2023, Mar 2024, and Jun 2024:

|

Particulars |

Dec 2023 |

Mar 2024 |

Jun 2024 |

|

Sales (Rs. Crores) |

12,165 |

11,555 |

11,932 |

|

Expenses (Rs. Crores) |

9,750 |

9,271 |

9,562 |

|

Operating Profit (Rs. Crores) |

2,415 |

2,284 |

2,370 |

|

OPM (%) |

20% |

20% |

20% |

|

Other Income (Rs. Crores) |

356 |

444 |

335 |

|

Interest (Rs. Crores) |

12 |

30 |

47 |

|

Depreciation (Rs. Crores) |

93 |

93 |

95 |

|

Profit Before Tax (Rs. Crores) |

2,666 |

2,606 |

2,564 |

|

Tax (%) |

24% |

23% |

24% |

|

Net Profit (Rs. Crores) |

2,033 |

2,011 |

1,942 |

|

EPS (Rs.) |

71.78 |

72.05 |

69.55 |

About Bajaj Auto

Bajaj Auto is a big company in India that makes motorcycles, scooters, and auto rickshaws. It was started on November 29, 1945, by Jamnalal Bajaj in Pune, Maharashtra. Originally, it imported two- and three-wheelers before getting permission from the Indian government to make its own in 1959. In 1960, the company became public. Over the years, Bajaj Auto became known for its motorcycles, especially after launching them in 1986.

Today, it is the third-largest motorcycle manufacturer in the world and the second-largest in India. It also holds the title of the world's largest maker of three-wheelers. In December 2020, Bajaj Auto became the most valuable two-wheeler company in the world, reaching a market value of ₹1 trillion (about US$12 billion). The current CEO is Rajiv Bajaj, and the company has around 8,826 employees as of March 2024.

Bajaj Auto Q1 Results - FAQs

1. What is Bajaj Auto's latest revenue figure for Q1 FY24?

Bajaj Auto reported a revenue of ₹11,932.07 crores for Q1 FY24.

2. How did Bajaj Auto's expenses change in Q1 FY24?

Bajaj Auto's selling, general, and administrative expenses increased to ₹491.81 crores in Q1 FY24.

3. What was Bajaj Auto's operating income for June 2024?

Bajaj Auto's operating income reached ₹2,275.43 crores for the quarter ending June 2024.

4. Did Bajaj Auto see a growth in net income for Q1 FY24?

Yes, Bajaj Auto's net income grew to ₹1,941.79 crores in Q1 FY24.

5. How many units did Bajaj Auto sell in Q1 FY24?

Bajaj Auto sold 1,102,056 units in Q1 FY24.

6. What were Bajaj Auto's earnings per share (EPS) for June 2024?

Bajaj Auto's diluted normalized EPS for Q1 FY24 was ₹69.60.

7. What was Bajaj Auto's profit before tax for Q1 FY24?

Bajaj Auto recorded a profit before tax of ₹2,563.78 crores in Q1 FY24.

8. How did Bajaj Auto's net profit for June 2024 compare to the previous year?

Bajaj Auto's net profit for June 2024 was ₹1,988.34 crores, up from ₹1,664.77 crores in June 2023.

9. What were Bajaj Auto's other income figures for Q1 FY24?

Bajaj Auto's other income for the quarter was ₹320.94 crores.

10. What is Bajaj Auto's total operating expense for Q1 FY24?

Bajaj Auto's total operating expense amounted to ₹9,656.64 crores for Q1 FY24.