- Home »

- Quarterly Results »

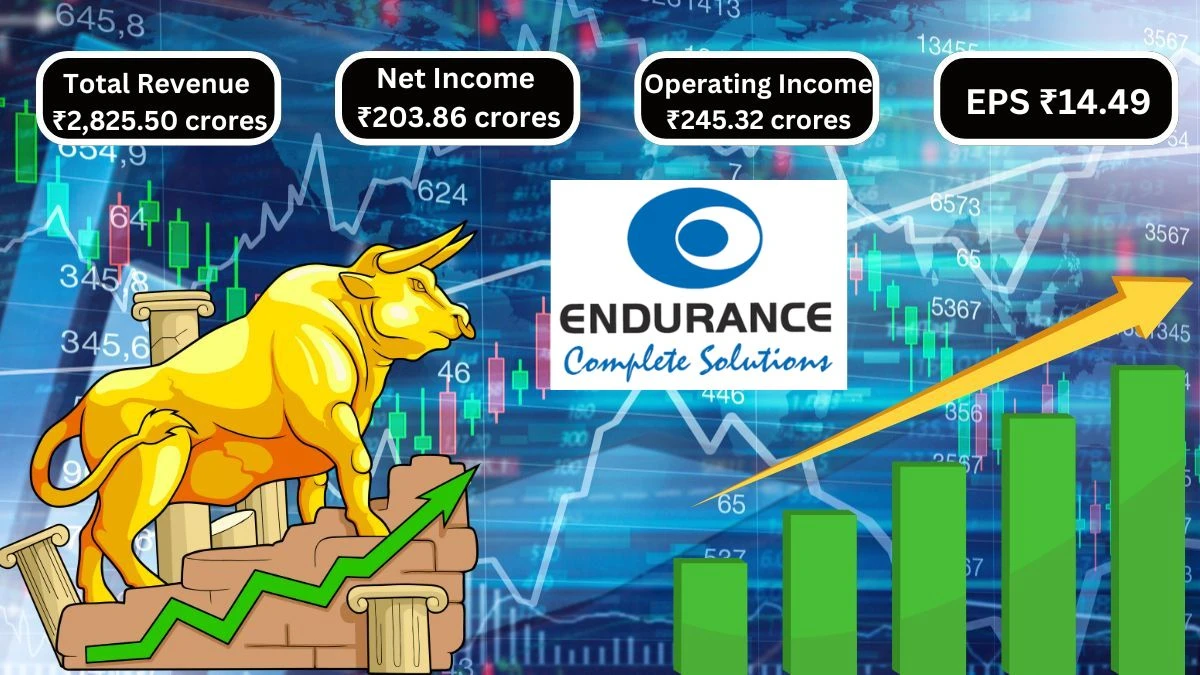

- Endurance Technologies Q1 Results Total Revenue ₹2,825.50 crores & Net Income ₹203.86 crores

Endurance Technologies Q1 Results Total Revenue ₹2,825.50 crores & Net Income ₹203.86 crores

Endurance Technologies Q1 Results Reaches a Total Revenue of ₹2,825.50 crores for Q1 and Net Income reached ₹203.86 crores, showing strong year-over-year growth, while Operating Income was ₹245.32 crores.

by Ruksana

Updated Sep 21, 2024

Table of Content

Endurance Technologies Quarterly Overview

Endurance Technologies Q1 Results: Endurance Technologies reported its Q1 results for June 2024, showing important financial details. The total revenue for this quarter was ₹2,825.50 crores, which is an increase of 5.24% compared to the previous quarter (QoQ) of ₹2,234.34 crores. Year-over-year (YoY), the revenue also grew by 15.33% from ₹2,449.96 crores in June 2023. Selling, general, and administrative expenses were ₹250.16 crores, up 10.28% QoQ from ₹209.15 crores and increased by 14.37% YoY from ₹218.73 crores. Other operating expenses reached ₹575.27 crores, which is a rise of 7.07% QoQ and 24.66% YoY compared to ₹461.47 crores last year.

Endurance Technologies’ Total operating expenses were ₹2,580.18 crores, showing a 6.46% increase QoQ and a 15.10% increase YoY from ₹2,241.64 crores. Operating income dropped by 6.07% QoQ to ₹245.32 crores but increased by 17.76% YoY from ₹208.32 crores. Net income was ₹203.86 crores, reflecting a 3.00% decline QoQ but a significant YoY rise of 24.68% from ₹163.50 crores. Finally, diluted normalized EPS was ₹14.49, down 3.01% QoQ but up 24.70% YoY from ₹11.62. Overall, the results show strong year-over-year growth despite some quarterly challenges.

Here’s a summary of Endurance Technologies' Q1 results for June 2024, in very simple English and table format:

|

Metric |

Jun 24 (in crores) |

Mar 23 (in crores) |

QoQ Change |

Jun 23 (in crores) |

YoY Change |

|

Total Revenue |

2,825.50 |

2,234.34 |

+5.24% |

2,449.96 |

+15.33% |

|

Selling/General/Admin Expenses |

250.16 |

209.15 |

+10.28% |

218.73 |

+14.37% |

|

Depreciation/Amortization |

128.76 |

121.56 |

+0.42% |

112.94 |

+14.01% |

|

Other Operating Expenses |

575.27 |

414.10 |

+7.07% |

461.47 |

+24.66% |

|

Total Operating Expense |

2,580.18 |

2,070.50 |

+6.46% |

2,241.64 |

+15.10% |

|

Operating Income |

245.32 |

163.83 |

-6.07% |

208.32 |

+17.76% |

|

Net Income Before Taxes |

267.97 |

176.67 |

-2.49% |

215.90 |

+24.12% |

|

Net Income |

203.86 |

136.47 |

-3.00% |

163.50 |

+24.68% |

|

Diluted Normalized EPS |

14.49 |

9.70 |

-3.01% |

11.62 |

+24.70% |

Source: Here

For More Q1 Results check our Twitter Page

Visit our website for more Q1 result

Endurance Technologies Q1 Results

The Endurance Technologies financial results table shows the company’s performance for the quarter ending June 30, 2024. The total revenue from operations was approximately ₹21,203.97 million, which is higher than the ₹18,253.68 million from the same quarter last year. This increase indicates that the company is selling more products or services. Other income, which includes different sources of revenue, added about ₹142.16 million, leading to a total income of ₹21,346.13 million.

Endurance Technologies spent ₹19,161.01 million. The largest expense was the cost of materials consumed, which was about ₹13,902.84 million. This expense shows how much it costs to produce the goods they sell. After subtracting expenses from total income, the profit before tax was ₹2,185.12 million. The company then paid taxes, which totaled ₹556.50 million. After taxes, the profit for the period was ₹1,628.62 million.

Endurance Technologies had an item in other comprehensive income showing a loss of ₹79.09 million, leading to a total comprehensive income of ₹1,549.53 million. Lastly, the earnings per share (EPS) for shareholders was ₹11.58, indicating how much profit each share earned during this period. Overall, the results show a positive growth trend for Endurance Technologies.

Here’s a simplified summary of the standalone unaudited financial results for Endurance for the quarter ended June 30, 2024:

(in million)

|

Particulars |

Quarter Ended |

Year Ended |

|

30th June 2024 |

31st March 2024 |

30th June 2023 |

|

Revenue from Operations |

21,203.97 |

20,786.34 |

|

Other Income |

142.16 |

144.85 |

|

Total Income (I + II) |

21,346.13 |

20,931.19 |

|

Expenses |

||

|

- Cost of Materials Consumed |

13,902.84 |

12,667.87 |

|

- Purchases of Stock-in-Trade |

134.77 |

116.80 |

|

- Changes in Stock |

(338.11) |

367.51 |

|

- Employee Benefits Expense |

1,076.81 |

980.79 |

|

- Finance Costs |

6.89 |

4.55 |

|

- Depreciation and Amortisation Expense |

692.25 |

673.11 |

|

- Other Expenses |

3,685.56 |

3,680.20 |

|

Total Expenses |

19,161.01 |

18,490.83 |

|

Profit Before Tax (III - IV) |

2,185.12 |

2,440.36 |

|

Tax Expense |

||

|

- Current Tax |

557.75 |

562.79 |

|

- Short/(Excess) Provision |

- |

(117.48) |

|

- Deferred Tax (Credit)/Charge |

(1.25) |

171.92 |

|

Total Tax Expense |

556.50 |

617.23 |

|

Profit for the Period/Year (V - VI) |

1,628.62 |

1,823.13 |

|

Other Comprehensive Income/(Loss) |

(79.09) |

(15.84) |

|

Total Comprehensive Income (VII + VIII) |

1,549.53 |

1,807.29 |

|

Paid-Up Equity Share Capital |

1,406.63 |

1,406.63 |

|

Earnings Per Share (Basic & Diluted) |

11.58 |

12.96 |

Endurance Technologies Financial Metrics

Endurance Technologies is a company with a market capitalization of ₹34,581 crore, meaning it is valued at this amount in the stock market. The current share price is ₹2,458, which can fluctuate between a high of ₹3,061 and a low of ₹1,525. The company's price-to-earnings (P/E) ratio is 48.0, indicating how much investors are willing to pay for each unit of earnings. Its book value is ₹354, which represents the company's net asset value per share. With a dividend yield of 0.35%, investors earn a small return from dividends.

Here’s a simplified summary of the provided financial data:

|

Metric |

Value |

|

Market Cap |

₹ 34,581 Cr |

|

Current Price |

₹ 2,458 |

|

High / Low |

₹ 3,061 / ₹ 1,525 |

|

Stock P/E |

48.0 |

|

Book Value |

₹ 354 |

|

Dividend Yield |

0.35 % |

|

ROCE |

16.6 % |

|

ROE |

13.6 % |

|

Face Value |

₹ 10.0 |

Quarterly Results

Here’s the table for the specified quarters (Dec 2023, Mar 2024, Jun 2024) with the particulars:

(Consolidated Figures in Rs. Crores)

|

Particulars |

Dec 2023 |

Mar 2024 |

Jun 2024 |

|

Sales |

2,561 |

2,685 |

2,826 |

|

Expenses |

2,262 |

2,295 |

2,451 |

|

Operating Profit |

299 |

389 |

374 |

|

OPM % |

12% |

14% |

13% |

|

Other Income |

27 |

27 |

34 |

|

Interest |

11 |

13 |

11 |

|

Depreciation |

114 |

128 |

129 |

|

Profit Before Tax |

201 |

275 |

268 |

|

Tax % |

24% |

24% |

24% |

|

Net Profit |

152 |

210 |

204 |

|

EPS in Rs |

10.83 |

14.94 |

14.49 |

About Endurance Technologies

Endurance Technologies is a company that specializes in manufacturing high-quality automotive components. Founded in 1985, it started with just two aluminum die-casting machines and has grown significantly over the years. Today, the company operates 32 manufacturing plants in three countries and exports products to more than 38 countries. Endurance focuses on quality, cost, and innovation to provide reliable solutions for its customers.

Endurance Technologies' mission is to be a trusted partner by ensuring product safety and sustainability. With a strong commitment to excellence, Endurance Technologies aims to create value for all its stakeholders.

Endurance Technologies Q1 Results - FAQs

1. What are the recent revenue trends for Endurance Technologies?

Endurance Technologies reported a total revenue of ₹2,825.50 crores for Q1 June 2024, a 15.33% increase year-over-year.

2. How have the operating expenses changed for Endurance Technologies?

Endurance Technologies experienced a total operating expense of ₹2,580.18 crores, up 15.10% compared to the previous year.

3. What is the net income reported by Endurance Technologies?

Endurance Technologies reported a net income of ₹203.86 crores for Q1 June 2024, showing a 24.68% increase year-over-year.

4. How much did Endurance Technologies spend on selling and administrative expenses?

Endurance Technologies' selling, general, and administrative expenses were ₹250.16 crores, up 14.37% from the previous year.

5. What are the key factors affecting Endurance Technologies' profit before tax?

Endurance Technologies' profit before tax was ₹267.97 crores, which is a 24.12% increase from the previous year.

6. How does Endurance Technologies' market capitalization compare?

Endurance Technologies has a market capitalization of ₹34,581 crores, indicating strong market performance.

7. What is the current share price of Endurance Technologies?

The current share price of Endurance Technologies is ₹2,458, with a high of ₹3,061 and a low of ₹1,525.

8. What are Endurance Technologies' operating income figures?

Endurance Technologies reported an operating income of ₹245.32 crores, showing a 17.76% increase year-over-year.

9. How much did Endurance Technologies earn from other income sources?

Endurance Technologies earned ₹142.16 million from other income in Q1 June 2024.

10. How has Endurance Technologies managed its expenses this quarter?

Endurance Technologies' total expenses for Q1 June 2024 were ₹19,161.01 million, highlighting effective cost management.