- Home »

- Quarterly Results »

- Havells India Q2 Results Strong YoY Revenue at ₹4,539.31 Crores

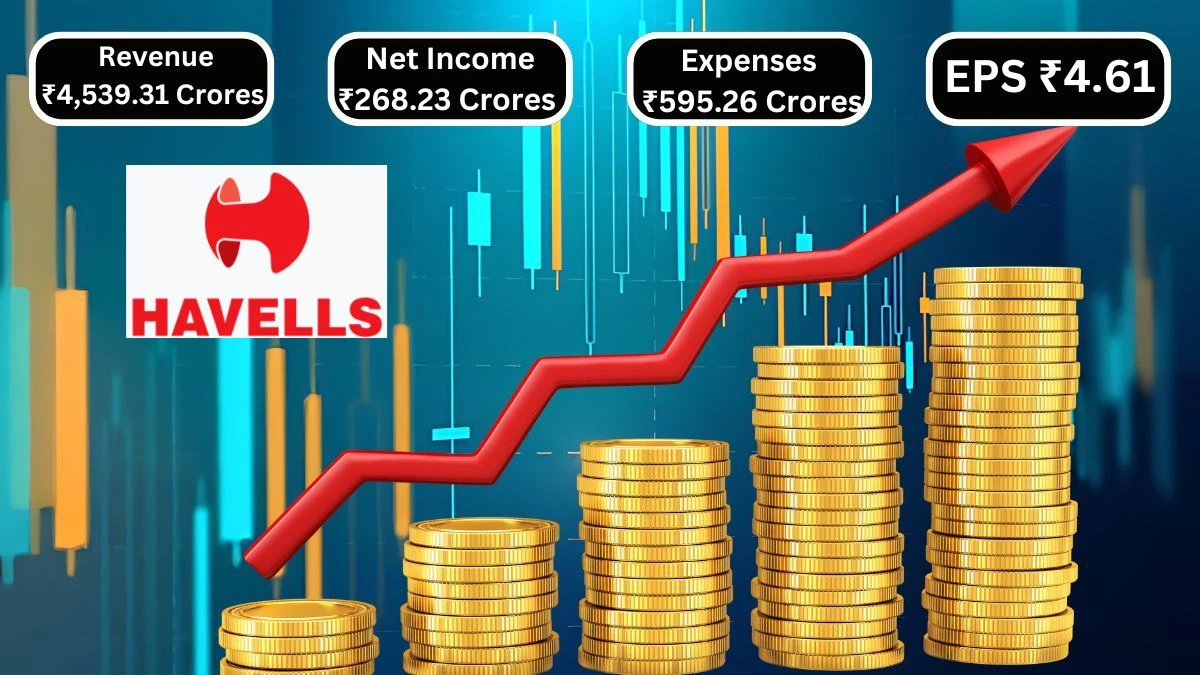

Havells India Q2 Results Strong YoY Revenue at ₹4,539.31 Crores

Havells India Q2 Results Reported Total Revenue of ₹4,539.31 Crores and Net Income of ₹268.23 Crores in Q2 2024and their Selling, General, and Administrative Expenses were ₹595.26 Crores for the same period.

by Ruksana

Updated Oct 21, 2024

Table of Content

Havells India Q2 Results: The table presents Havells India's financial performance for Q2 2024, showing key figures compared to both the previous quarter and the same quarter last year. In terms of Year-over-Year (YoY) growth, Havells India achieved a total revenue of ₹4,539.31 Crores, which is a YoY increase of 16.38% compared to ₹3,900.33 Crores in Q2 2023. However, when we look at the Quarter-on-Quarter (QoQ) results, there is a significant drop in revenue of 21.82% from the previous quarter, which reported ₹5,806.21 Crores. This highlights a challenging period for the company.

Havells reported ₹268.23 Crores in Q2 2024, marking a YoY growth of 7.69% from ₹249.08 Crores in Q2 2023. Yet again, the QoQ performance shows a decline of 34.24%, down from ₹407.90 Crores in Q1 2024. The Selling, General, and Administrative Expenses also show a YoY increase of 28.58%, reflecting rising costs. Interestingly, these expenses decreased by 6.11% when compared Quarter-on-Quarter.

Here’s a simplified summary of Havells India’s Q2 results for 2024:

(Rs. in crores, except the crores)

|

Period |

Q2 |

Q1 |

QoQ Growth |

Q2 YoY Growth |

|

Total Revenue |

4539.31 |

5806.21 |

-21.82% |

+16.38% |

|

Selling/General/Admin Expenses |

595.26 |

634.02 |

-6.11% |

+28.58% |

|

Depreciation/Amortization |

94.62 |

92.02 |

+2.83% |

+16.56% |

|

Total Operating Expense |

4258.86 |

5325.99 |

-20.04% |

+18.03% |

|

Operating Income |

280.45 |

480.22 |

-41.6% |

-4.01% |

|

Net Income Before Taxes |

363.26 |

549 |

-33.83% |

+8.33% |

|

Net Income |

268.23 |

407.9 |

-34.24% |

+7.69% |

|

Diluted Normalized EPS |

4.61 |

6.52 |

-29.28% |

+16.67% |

Source: Here

For More Quarterly Results check our Twitter Page

Visit our website for more Quarterly results

Havells India Q2 Results

Havells India reported its financial results for the quarter and half-year ending on September 30, 2024. In the quarter ended September 30, 2024, the company made ₹4,532.99 crores from its operations, which is higher than the ₹3,891.24 crores earned during the same quarter last year. Overall, their total income for this quarter was ₹4,625.75 crores, a noticeable increase from ₹3,943.63 crores in the previous year.

Havells India earned ₹10,331.10 crores from operations, compared to ₹8,714.94 crores last year. Their expenses also went up but at a slower rate than their income. The company's total expenses for the quarter were ₹4,257.67 crores, resulting in a profit before tax of ₹368.08 crores. After taxes, the profit for the quarter was ₹272.59 crores, which is higher than the ₹249.10 crores from last year.

Havells reported a Basic Earnings Per Share (EPS) of ₹4.35, compared to ₹3.97 from the previous year.

Here’s a summarized financial result based on the provided data for the quarter and half-year ended September 30, 2024.

|

Particulars |

Quarter Ended |

Half Year Ended |

Year Ended (Audited) |

|

30-Sep-24 |

30-Sep-24 |

31-Mar-24 |

|

|

(Unaudited) |

(Unaudited) |

(Audited) |

|

|

Income |

|||

|

Revenue from operations |

₹4,532.99 Crores |

₹10,331.10 Crores |

₹18,549.90 Crores |

|

Other Income |

₹92.76 Crores |

₹169.79 Crores |

₹248.73 Crores |

|

Total Income |

₹4,625.75 Crores |

₹10,600.89 Crores |

₹18,798.63 Crores |

|

Expenses |

|||

|

Cost of raw materials and components consumed |

₹2,443.89 Crores |

₹5,532.15 Crores |

₹9,873.77 Crores |

|

Purchase of traded goods |

₹890.27 Crores |

₹1,628.11 Crores |

₹2,420.02 Crores |

|

Change in inventories |

(₹331.50) Crores |

(₹207.64) Crores |

₹242.73 Crores |

|

Employee benefits expense |

₹460.21 Crores |

₹918.38 Crores |

₹1,541.06 Crores |

|

Finance costs |

₹10.08 Crores |

₹18.63 Crores |

₹45.71 Crores |

|

Depreciation and amortization expense |

₹94.62 Crores |

₹186.63 Crores |

₹338.48 Crores |

|

Net impairment losses |

₹28.12 Crores |

₹31.51 Crores |

₹17.62 Crores |

|

Other expenses |

|||

|

- Advertisement and sales promotion |

₹130.10 Crores |

₹302.47 Crores |

₹527.36 Crores |

|

- Others |

₹531.88 Crores |

₹1,169.90 Crores |

₹2,082.05 Crores |

|

Total Expenses |

₹4,257.67 Crores |

₹9,580.14 Crores |

₹17,088.80 Crores |

|

Profit before Tax |

₹368.08 Crores |

₹920.75 Crores |

₹1,709.83 Crores |

|

Income Tax Expense |

|||

|

Current tax |

₹90.59 Crores |

₹232.07 Crores |

₹440.61 Crores |

|

Deferred tax (Credit)/Charge |

₹4.90 Crores |

₹4.91 Crores |

(₹3.99) Crores |

|

Total Tax Expense |

₹95.49 Crores |

₹236.98 Crores |

₹436.62 Crores |

|

Profit for the Period |

₹272.59 Crores |

₹683.77 Crores |

₹1,273.21 Crores |

|

Other Comprehensive Income/(Loss) |

|||

|

Re-measurement gain/loss on defined benefit plan |

(₹1.79) Crores |

(₹3.57) Crores |

(₹6.43) Crores |

|

Income tax effect on the above |

₹0.45 Crores |

₹0.90 Crores |

₹1.62 Crores |

|

Other Comprehensive Income/(Loss), net of tax |

(₹1.34) Crores |

(₹2.67) Crores |

(₹4.81) Crores |

|

Total Comprehensive Income for the Period |

₹271.25 Crores |

₹681.10 Crores |

₹1,268.40 Crores |

|

Paid-up Equity Share Capital |

₹62.69 Crores |

₹62.69 Crores |

₹62.67 Crores |

|

Reserves (excluding revaluation reserve) |

₹7,375.78 Crores |

||

|

Earnings per Equity Share (EPS) |

|||

|

Basic EPS (Rs.) |

₹4.35 |

₹10.91 |

₹20.32 |

|

Diluted EPS (Rs.) |

₹4.35 |

₹10.91 |

₹20.32 |

Havells India Stock Performance

Havells India’s market capitalization is ₹1,15,965 crores, showing its strong position in the market. The current stock price is ₹1,850, and it has reached a high of ₹2,106 and a low of ₹1,233 in recent times. The company's price-to-earnings (P/E) ratio is 82.2, indicating how investors value its earnings. The book value is ₹124, which shows the company's net asset value per share. Havells offers a dividend yield of 0.49%, meaning investors receive some returns. The return on capital employed (ROCE) is 24.4%, and the return on equity (ROE) is 18%, reflecting good profitability.

Here’s the information presented in a simple table format:

|

Financial Metric |

Value |

|

Market Cap |

₹ 1,15,965 Cr. |

|

Current Price |

₹ 1,850 |

|

High / Low |

₹ 2,106 / ₹ 1,233 |

|

Stock P/E |

82.2 |

|

Book Value |

₹ 124 |

|

Dividend Yield |

0.49 % |

|

ROCE |

24.4 % |

|

ROE |

18.0 % |

|

Face Value |

₹ 1.00 |

Quarterly Results

In the quarterly results for Havells India, looking at Mar 2024, Jun 2024, and Sep 2024, we see important financial changes. In Mar 2024, sales were the highest at 5,442 Rs. Crores, leading to a net profit of 447 Rs. Crores and earnings per share (EPS) of 7.13 Rs. This showed strong performance. However, in Jun 2024, sales increased to 5,806 Rs. Crores, but net profit dropped to 408 Rs. Crores and EPS decreased to 6.51 Rs. In Sep 2024, sales fell to 4,539 Rs. Crores, with a further drop in net profit to 268 Rs. Crores and EPS to 4.28 Rs.

Here’s the table focusing on the quarters Mar 2024, Jun 2024, and Sep 2024 along with the respective particulars:

|

Particulars |

Mar 2024 (Rs. Crores) |

Jun 2024 (Rs. Crores) |

Sep 2024 (Rs. Crores) |

|

Sales |

5,442 |

5,806 |

4,539 |

|

Expenses |

4,807 |

5,234 |

4,164 |

|

Operating Profit |

635 |

572 |

375 |

|

OPM (%) |

12% |

10% |

8% |

|

Other Income |

76 |

77 |

93 |

|

Interest |

18 |

9 |

10 |

|

Depreciation |

93 |

92 |

95 |

|

Profit Before Tax |

599 |

549 |

363 |

|

Tax (%) |

25% |

26% |

26% |

|

Net Profit |

447 |

408 |

268 |

|

EPS (Rs) |

7.13 |

6.51 |

4.28 |

About Havells India

Havells India is a major electrical equipment company based in Noida, India. Founded in 1958 by Qimat Rai Gupta, it has grown into a global brand known for its high-quality products. Havells makes a wide range of items, including home appliances, lighting, fans, and electrical equipment like cables and motors. The company operates 11 manufacturing plants across India and has offices in over 50 countries, employing around 6,000 people.

Havells is also known for acquiring other companies to expand its reach, including the European lighting company Sylvania and the consumer durables business of Lloyd Electricals. It owns several popular brands, such as Havells, Lloyd, and Crabtree. With a strong focus on innovation and quality, Havells has become a trusted name in electrical goods, making everyday life easier for people all around the world.

Havells India Q2 Results - FAQs

1. What was Havells India's total revenue for Q2 2024?

Havells India's total revenue for Q2 2024 was ₹4,539.31 Crores.

2. How much did Havells India earn in net income for Q2 2024?

Havells India reported a net income of ₹268.23 Crores for Q2 2024.

3. What is the YoY growth of Havells India's total revenue in Q2 2024?

Havells India achieved a YoY growth of 16.38% in total revenue for Q2 2024.

4. How did Havells India’s net income in Q2 2024 compare to Q1 2024?

Havells India's net income in Q2 2024 decreased by 34.24% compared to Q1 2024.

5. How much were Havells India's total expenses in Q2 2024?

Havells India's total expenses for Q2 2024 amounted to ₹4,257.67 Crores.

6. What is the market capitalization of Havells India?

Havells India has a market capitalization of ₹1,15,965 Crores.

7. What was the P/E ratio of Havells India as of Q2 2024?

Havells India's P/E ratio stood at 82.2 as of Q2 2024.

8. How much did Havells India’s profit before tax amount to in Q2 2024?

Havells India's profit before tax for Q2 2024 was ₹368.08 Crores.

9. What was the quarterly decline in sales for Havells India from Q1 to Q2 2024?

Havells India experienced a quarterly decline of 21.82% in sales from Q1 to Q2 2024.

10. How did Havells India's operating income change from Q1 to Q2 2024?

Havells India's operating income fell to ₹280.45 Crores in Q2 2024, down from ₹480.22 Crores in Q1 2024.