- Home »

- Quarterly Results »

- Hindustan Zinc Q2 Results Strong Net Profit of ₹2,200 Crore

Hindustan Zinc Q2 Results Strong Net Profit of ₹2,200 Crore

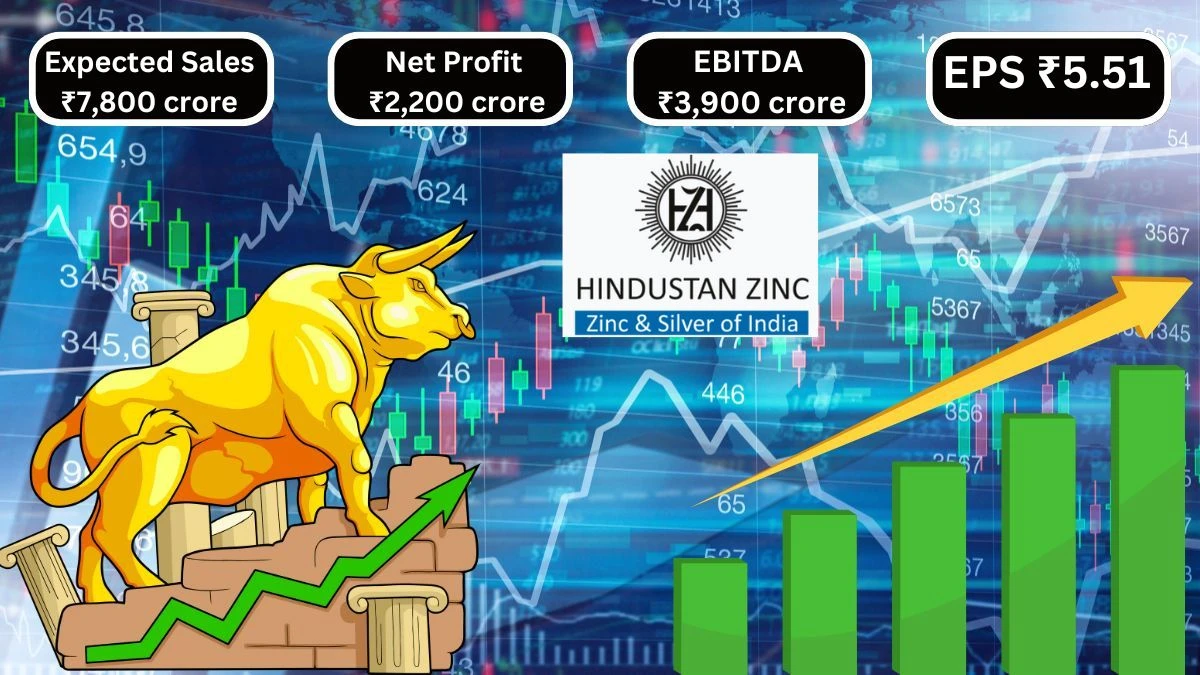

Hindustan Zinc Q2 Results show Expected Sales of ₹7,800 crore, a Net Profit of ₹2,200 crore, and an EBITDA of ₹3,900 crore, While Sales grew by 15% year-on-year, while Net Profit increased by 29%.

by Ruksana

Updated Oct 19, 2024

Table of Content

Hindustan Zinc Q2 Results: Hindustan Zinc recently announced its results for the second quarter of the financial year 2025 (Q2FY25), which were released on October 18, 2024. The company reported expected sales of ₹7,800 crore, marking a 15% increase compared to the same quarter last year. However, there was a slight decline of 4% when compared to the previous quarter. The net profit for this quarter is projected to be ₹2,200 crore, reflecting a significant year-on-year growth of 29%. Yet, this represents a 5% decrease from the prior quarter.

Hindustan Zinc’s Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) is expected to reach ₹3,900 crore, showing a healthy increase of 23% compared to last year, with no change from the previous quarter. Analysts have noted that sales of zinc are expected to rise by 7%, while lead sales are anticipated to grow by 10.5%. Silver sales are expected to increase by 1.7%. The growth in EBITDA is largely attributed to higher prices for zinc and silver and improved sales volumes.

Source: Here

For More Quarterly Results check our Twitter Page

Visit our website for more Quarterly results

Hindustan Zinc Q2 Results

The Hindustan Zinc financial results table shows the company's performance for the quarter and half-year ending September 30, 2024. For the quarter, the total income was ₹8,522 crore, which is a significant increase from ₹7,014 crore in the same quarter last year. This shows that the company earned more money from its operations and other income sources. The revenue from operations alone reached ₹8,004 crore, also higher than the previous year.

Hindustan Zinc’s Expenses totaled ₹5,309 crore, reflecting the costs involved in running the business, including employee salaries, power costs, and mining royalties. Despite these expenses, Hindustan Zinc reported a profit before tax of ₹3,130 crore for the quarter, which indicates good financial health. After paying taxes, the net profit was ₹2,327 crore, an increase from ₹1,729 crore in the same quarter last year.

Hindustan Zinc’s earnings per share were ₹5.51, showing that each share of the company is earning a good return.

Here's a structured summary of the unaudited consolidated financial results for the quarter and half-year ended September 30, 2024:

(in crore ₹)

|

Particulars |

Quarter Ended |

Half Year Ended |

Year Ended |

|

30.09.2024 |

30.09.2024 |

31.03.2024 |

|

|

30.06.2024 |

30.09.2023 |

||

|

Unaudited |

Unaudited |

Audited |

|

|

1. Revenue from operations |

8,004 |

15,897 |

28,082 |

|

2. Other operating income |

248 |

485 |

850 |

|

3. Other income |

270 |

538 |

1,074 |

|

Total Income |

8,522 |

16,920 |

30,006 |

|

4. Expenses |

|||

|

a. Changes in inventories |

173 |

239 |

(157) |

|

b. Employee benefit expense |

187 |

416 |

828 |

|

c. Depreciation and amortisation |

877 |

1,771 |

3,468 |

|

d. Power and fuel |

702 |

1,367 |

2,843 |

|

e. Mining royalty |

943 |

1,905 |

3,517 |

|

f. Finance costs |

303 |

559 |

955 |

|

g. Other expenses |

2,124 |

4,386 |

8,245 |

|

Total Expenses |

5,309 |

10,593 |

19,699 |

|

5. Profit before tax and exceptional items |

3,213 |

6,327 |

10,307 |

|

6. Exceptional items |

(83) |

(83) |

|

|

7. Profit Before Tax |

3,130 |

5,244 |

10,307 |

|

8. Tax Expense |

|||

|

Current tax |

827 |

1,656 |

2,549 |

|

Deferred tax |

(24) |

(84) |

(1) |

|

Net Tax Expense |

803 |

1,572 |

2,548 |

|

9. Net Profit |

2,327 |

4,672 |

7,759 |

|

10. Other Comprehensive Income/(Loss) |

|||

|

(i) Items not reclassified to profit/loss |

3 |

(15) |

(8) |

|

(ii) Items that will be reclassified |

25 |

1 |

2 |

|

Total Other Comprehensive Income/(Loss) |

24 |

6 |

(3) |

|

11. Total Comprehensive Income |

2,351 |

4,678 |

7,756 |

|

12. Paid up Equity Share Capital |

845 |

845 |

845 |

|

13. Reserves |

14,350 |

||

|

14. Earnings Per Share (not annualised) |

|||

|

a. Basic |

5.51 |

11.06 |

18.36 |

|

b. Diluted |

5.51 |

11.06 |

18.36 |

Hindustan Zinc Financial Performance

Hindustan Zinc is a large company with a market capitalization of ₹2,14,012 crores, meaning it has a high total value in the stock market. The current price of its shares is ₹506, and in the past, it reached a high of ₹808 and a low of ₹285. The price-to-earnings (P/E) ratio is 24.3, showing how much investors are willing to pay for each unit of earnings. The company's book value is ₹18.0, indicating its total assets minus liabilities. It offers a good dividend yield of 5.73%, which is the return on investment from dividends.

Here’s a table summarizing the financial details you provided:

|

Financial Metric |

Value |

|

Market Cap |

₹ 2,14,012 Cr. |

|

Current Price |

₹ 506 |

|

High / Low |

₹ 808 / ₹ 285 |

|

Stock P/E |

24.3 |

|

Book Value |

₹ 18.0 |

|

Dividend Yield |

5.73% |

|

ROCE |

46.2% |

|

ROE |

55.1% |

|

Face Value |

₹ 2.00 |

Quarterly Results

The Hindustan Zinc table shows financial results for three quarters: March 2024, June 2024, and September 2024. In March 2024, sales were Rs. 7,549 crores, and expenses were Rs. 3,900 crores, leading to an operating profit of Rs. 3,649 crores, with a profit margin of 48%. By June 2024, sales increased to Rs. 8,130 crores, and expenses rose to Rs. 4,184 crores, resulting in a higher operating profit of Rs. 3,946 crores, with a profit margin of 49%. In September 2024, sales continued to grow to Rs. 8,252 crores, expenses slightly decreased to Rs. 4,129 crores, leading to an operating profit of Rs. 4,123 crores and a profit margin of 50%.

Here’s the table with the Mar 2024, Jun 2024, and Sep 2024 figures:

(Consolidated Figures in Rs. Crores)

|

Particulars |

Mar 2024 |

Jun 2024 |

Sep 2024 |

|

Sales |

7,549 |

8,130 |

8,252 |

|

Expenses |

3,900 |

4,184 |

4,129 |

|

Operating Profit |

3,649 |

3,946 |

4,123 |

|

OPM % |

48% |

49% |

50% |

|

Other Income |

273 |

268 |

187 |

|

Interest |

262 |

256 |

303 |

|

Depreciation |

937 |

844 |

877 |

|

Profit Before Tax |

2,723 |

3,114 |

3,130 |

|

Tax % |

25% |

25% |

26% |

|

Net Profit |

2,038 |

2,345 |

2,327 |

|

EPS in Rs |

4.82 |

5.55 |

5.51 |

About Hindustan Zinc

Hindustan Zinc is a major mining company based in Udaipur, Rajasthan, India. Founded in 1966, it produces essential metals like zinc, lead, silver, and cadmium. HZL was originally a public sector company but was sold to Vedanta in 2003 as part of a government plan to privatize loss-making firms. Today, it is the second-largest zinc producer in the world. The company focuses on sustainable mining practices and has made significant investments in technology and infrastructure to improve its operations.

In 2024, HZL reported revenues of ₹30,006 crore (around $3.6 billion) and employed about 23,796 people. HZL plays a vital role in India's economy, supplying essential materials for various industries, including construction and automotive. With a commitment to safety and environmental responsibility, Hindustan Zinc continues to grow while contributing to the country's development.

Hindustan Zinc Q2 Results - FAQs

1. What was Hindustan Zinc's total income for Q2 FY25?

Hindustan Zinc's total income for Q2 FY25 was ₹8,522 crore.

2. What are the sales figures reported by Hindustan Zinc for Q2 FY25?

Hindustan Zinc reported sales of ₹7,800 crore for Q2 FY25.

3. How much did Hindustan Zinc earn in net profit for Q2 FY25?

Hindustan Zinc's net profit for Q2 FY25 was ₹2,200 crore.

4. What is the EBITDA reported by Hindustan Zinc for Q2 FY25?

Hindustan Zinc's EBITDA for Q2 FY25 is ₹3,900 crore.

5. How much did Hindustan Zinc's expenses total for Q2 FY25?

Hindustan Zinc's total expenses for Q2 FY25 were ₹5,309 crore.

6. What were the lead sales growth figures for Hindustan Zinc?

Hindustan Zinc's lead sales are expected to grow by 10.5%.

7. What is the market capitalization of Hindustan Zinc?

Hindustan Zinc's market capitalization is ₹2,14,012 crore.

8. What is the dividend yield offered by Hindustan Zinc?

Hindustan Zinc offers a dividend yield of 5.73%.

9. What is the return on equity (ROE) for Hindustan Zinc?

Hindustan Zinc's return on equity (ROE) is 55.1%.

10. What was Hindustan Zinc's profit before tax for Q2 FY25?

Hindustan Zinc's profit before tax for Q2 FY25 was ₹3,130 crore.