- Home »

- Quarterly Results »

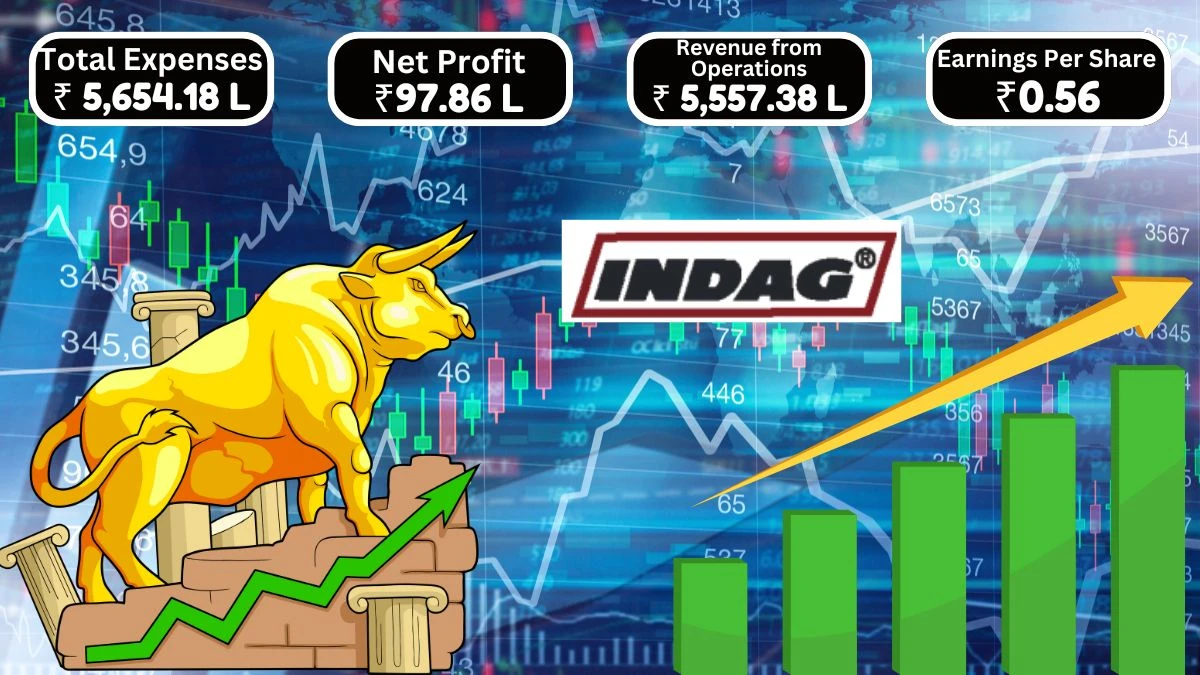

- Indag Rubber Q1 Results Reported Revenue at ₹5,557.38 Lakh with Profit After Tax of ₹97.86 Lakh

Indag Rubber Q1 Results Reported Revenue at ₹5,557.38 Lakh with Profit After Tax of ₹97.86 Lakh

Indag Rubber Q1 Results show a total income of ₹5,794.40 lakh, a QoQ decrease of 9.20%, with an operating profit of ₹-0.72 Cr and a profit after tax down 67.39% YoY, leading to an operating margin of -1.29%; Indag Rubber Q1 Results highlight ongoing challenges in the market.

by P Nandhini

Updated Sep 21, 2024

Table of Content

Indag Rubber Q1 Results 2024-2025: Indag Rubber announced their Q1 results on August 14, 2024, showing a decrease in revenue by 9.36% compared to the previous quarter (QoQ). The company reported total revenue from operations of ₹5,557.38 lakh, down from ₹6,132.41 lakh in the last quarter.

This decline in revenue reflects challenges faced in the tire retreading market, which Indag Rubber aims to address as it continues to innovate and adapt. In terms of profitability, Indag Rubber saw a significant drop in profit after tax, which fell by 67.39% year-over-year (YoY), from ₹299.83 lakh in the previous quarter to ₹97.86 lakh this quarter.

The decrease in profits highlights the ongoing pressures on costs, particularly in materials and operational expenses. As you consider Indag Rubber’s performance, the company’s focus on reducing costs and improving efficiency will be crucial for future quarters.

With these results, you can see the importance of strategic planning as Indag Rubber navigates the current economic landscape.

For More Q1 results check our Twitter Page

Indag Rubber Q1 Results 2024 - 2025

Here’s a summary of Indag Rubber’s Q1 results for 2024-2025. The figures highlight the company's financial performance and key metrics for the quarter.

| Particulars | Q1 FY 2024-2025 (Unaudited) | Q4 FY 2023-2024 (Audited) | Change (QoQ) |

|---|---|---|---|

| Revenue from Operations | ₹5,557.38 lakh | ₹6,132.41 lakh | -9.36% |

| Other Income | ₹237.02 lakh | ₹251.36 lakh | -5.67% |

| Total Income | ₹5,794.40 lakh | ₹6,383.77 lakh | -9.20% |

| Cost of Materials Consumed | ₹3,960.44 lakh | ₹4,162.00 lakh | -4.83% |

| Employee Benefits Expense | ₹724.17 lakh | ₹640.77 lakh | +12.96% |

| Total Expenses | ₹5,654.18 lakh | ₹5,976.46 lakh | -5.39% |

| Profit Before Tax | ₹140.22 lakh | ₹407.31 lakh | -65.56% |

| Profit After Tax | ₹97.86 lakh | ₹299.83 lakh | -67.39% |

Source: Click Here

Indag Rubber Current Market Overview

Indag Rubber is currently trading at ₹225 per share, showing a slight decrease of 0.64%. The company's market capitalization stands at ₹590 crore. Over the past year, the stock has reached a high of ₹308 and a low of ₹123. It has a price-to-earnings (P/E) ratio of 50.0, and its book value is ₹86.2.

Investors can expect a dividend yield of 1.33%. Overall, Indag Rubber is working to maintain its position in the market while focusing on growth and profitability.

| Metric | Value |

|---|---|

| Current Price | ₹225 |

| Change | -0.64% |

| Market Capitalization | ₹590 Cr. |

| High / Low | ₹308 / ₹123 |

| Stock P/E | 50.0 |

| Book Value | ₹86.2 |

| Dividend Yield | 1.33% |

| Face Value | ₹2.00 |

Quarterly Results

Here’s a summary of Indag Rubber's quarterly results for the last three quarters: December 2023, March 2024, and June 2024. The table highlights key financial metrics such as sales, expenses, operating profit, and net profit.

| Metric | Dec 2023 | Mar 2024 | Jun 2024 |

|---|---|---|---|

| Sales (₹ Cr) | 62.33 | 61.32 | 55.57 |

| Expenses (₹ Cr) | 58.39 | 58.20 | 54.66 |

| Operating Profit (₹ Cr) | 3.94 | 3.12 | 0.91 |

| Net Profit (₹ Cr) | 3.50 | 3.00 | 0.98 |

| EPS (₹) | 1.36 | 1.22 | 0.56 |

About Indag Rubber

Indag Rubber is a leading company in India that specializes in manufacturing products for retreading tires. Founded in 1978, it started as a joint venture between the Khemka group and M/S Bandag from the USA.

The company produces various items, including pre-cured tread rubber, rubber cement, and bonding gum. Indag Rubber is known for introducing cold retreading technology in India, which has helped improve tire recycling and reduce costs.

With two manufacturing plants located in Bhiwadi, Rajasthan, and Nalagarh, Himachal Pradesh, Indag Rubber aims to support fleet owners in lowering tire expenses and minimizing their environmental impact.

Check our website for more Q1 results.

Indag Rubber Q1 Results - FAQs

1. What was Indag Rubber's total revenue from operations in Q1 FY 2024-2025?

Indag Rubber reported total revenue of ₹5,557.38 lakh in Q1 FY 2024-2025.

2. How much did Indag Rubber's revenue decrease in Q1 FY 2024-2025?

Indag Rubber's revenue decreased by 9.36% QoQ.

3. What was Indag Rubber's profit after tax in Q1 FY 2024-2025?

Indag Rubber's profit after tax was ₹97.86 lakh in Q1 FY 2024-2025.

4. What was the decline in Indag Rubber's profit after tax compared to the previous quarter?

Indag Rubber's profit after tax declined by 67.39% QoQ.

5. What was Indag Rubber's total income for Q1 FY 2024-2025?

Indag Rubber's total income was ₹5,794.40 lakh in Q1 FY 2024-2025.

6. What was the employee benefits expense for Indag Rubber in Q1 FY 2024-2025?

Indag Rubber's employee benefits expense was ₹724.17 lakh, a 12.96% increase QoQ.

7. How did Indag Rubber's total expenses change in Q1 FY 2024-2025?

Indag Rubber's total expenses decreased by 5.39% QoQ.

8. What was Indag Rubber's operating margin for Q1 FY 2024-2025?

Indag Rubber's operating margin was -1.29% in Q1 FY 2024-2025.

9. When was Indag Rubber's Q1 FY 2024-2025 results announced?

Indag Rubber's Q1 results were announced on August 14, 2024.

10. What was Indag Rubber's profit before tax for Q1 FY 2024-2025?

Indag Rubber's profit before tax was ₹140.22 lakh in Q1 FY 2024-2025.