- Home »

- Quarterly Results »

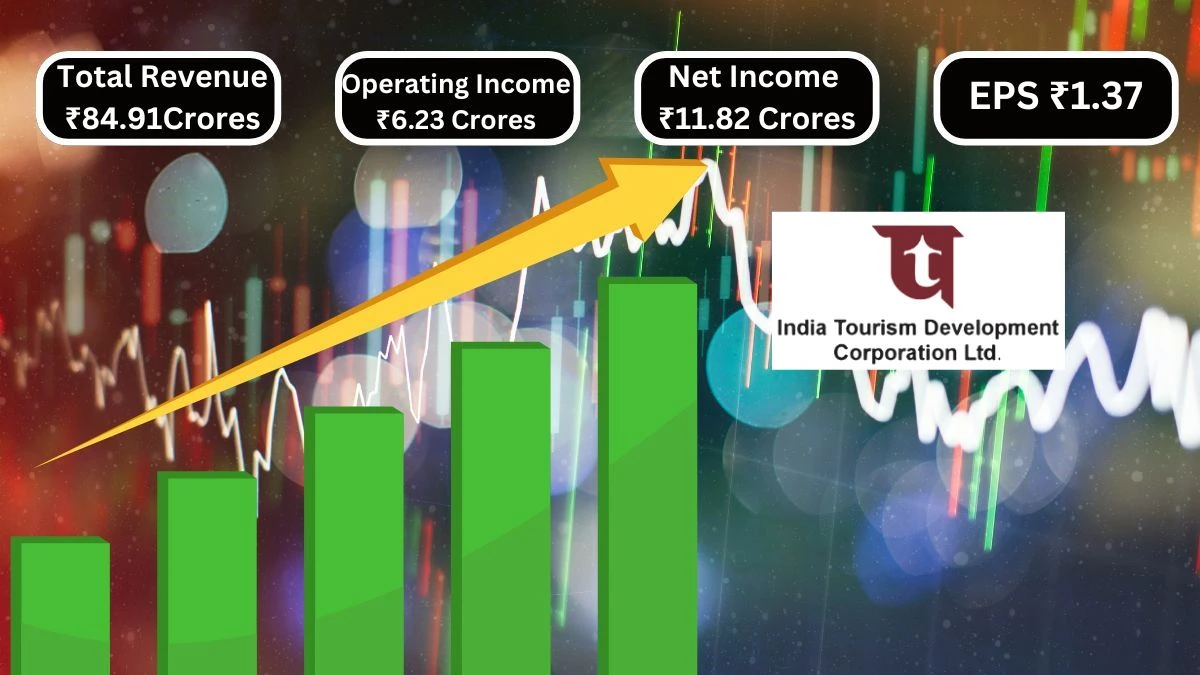

- India Tourism Development Corporation Q1 Results Total Revenue ₹84.91Crores & Operating Income ₹6.23 Crores

India Tourism Development Corporation Q1 Results Total Revenue ₹84.91Crores & Operating Income ₹6.23 Crores

India Tourism Development Corporation Q1 Results Total Revenue was ₹84.91 crores, down 28.15% YoY and 42.58% QoQ and Operating Income decreased to ₹6.23 crores, reflecting a 69.87% YoY drop.

by Ruksana

Updated Sep 18, 2024

Table of Content

India Tourism Development Corporation Quarterly Comparison

The India Tourism Development Corporation’s financial results for the quarter ending in June 2024 show significant changes. Comparing the data year-over-year (YoY) with the same period last year (June 2023), there is a noticeable decline. Total revenue YoY dropped by 28.15%, falling to 84.91 crores from 118.17 crores. This decrease reflects a challenging period for the company. When looking at the quarter-on-quarter (QoQ) performance, revenue fell sharply by 42.58% from the previous quarter (March 2023), where it was 156.47 crores.

India Tourism Development Corporation’s expenses also decreased YoY. Selling, general, and administrative expenses fell slightly by 1.40% YoY but decreased more significantly by 32.58% QoQ. Other operating expenses decreased YoY by 5.43% but were down by 31.03% compared to the previous quarter. Despite these reductions, the operating income fell drastically by 69.87% YoY, indicating that the lower expenses were not enough to offset the drop in revenue.

India Tourism Development Corporation’s Net income also decreased YoY by 32.13%, showing reduced profitability from last year. The diluted normalized earnings per share (EPS) fell significantly both YoY and QoQ. Overall, the results highlight a tough financial period, with substantial declines in revenue and profitability both year-over-year and quarter-on-quarter.

Here's a simplified overview of the India Tourism Development Corporation's Q1 results for June 2024:

(Values in ₹)

|

Metric |

Jun 24 |

Mar 23 |

QoQ Change |

Jun 23 |

YoY Change |

|

Total Revenue |

84.91 crores |

156.47 crores |

-42.58% |

118.17 crores |

-28.15% |

|

Selling/General/Admin Expenses |

21.87 crores |

32.35 crores |

-32.58% |

22.18 crores |

-1.40% |

|

Depreciation/Amortization |

1.59 crores |

1.23 crores |

+29.27% |

1.67 crores |

-5.11% |

|

Other Operating Expenses |

38.24 crores |

55.39 crores |

-31.03% |

36.28 crores |

+5.43% |

|

Total Operating Expense |

78.68 crores |

133.50 crores |

-32.89% |

97.51 crores |

-19.30% |

|

Operating Income |

6.23 crores |

22.97 crores |

-72.90% |

20.66 crores |

-69.87% |

|

Net Income Before Taxes |

9.64 crores |

25.01 crores |

-61.47% |

24.96 crores |

-61.38% |

|

Net Income |

11.82 crores |

14.00 crores |

-15.57% |

17.41 crores |

-32.13% |

|

Diluted Normalized EPS |

1.37 |

1.78 |

-23.00% |

2.04 |

-32.83% |

Source: Here

For More Q1 Results check our Twitter Page

Visit our website for more Q1 results

India Tourism Development Corporation Q1 Results

Tourism Development Corporation earned ₹8,491.04 lakhs from its operations for the quarter ended June 30, 2024, which is lower than the ₹11,817.04 lakhs it earned in the same quarter of 2023. The total income, which includes other sources like investments, was ₹8,846.72 lakhs, also down from ₹12,256.53 lakhs a year earlier. The company’s total expenses, including costs like materials, employee salaries, and other operational costs, were ₹7,882.80 lakhs for this quarter, compared to ₹9,770.47 lakhs last year.

Tourism Development Corporation’s profit before tax was ₹963.92 lakhs, which is significantly lower than the ₹2,486.06 lakhs from the previous year. After accounting for taxes and other items, the net profit from continuing operations was ₹1,177.98 lakhs, while it was ₹1,717.22 lakhs in the same quarter last year. The net profit from discontinued operations was negative, showing a loss of ₹6.14 lakhs.

Tourism Development Corporation’s total profit for the period was ₹1,171.84 lakhs, down from ₹1,712.74 lakhs in the previous year. The earnings per share, which measures the company's profitability per share, was ₹1.37, compared to ₹2.00 a year ago. This table helps investors understand how ITDC is performing and how its financial results compare to previous periods.

Here is the simplified financial summary based on the provided statement:

|

Particulars |

Quarter Ended 30th June 2024 |

Quarter Ended 30th June 2023 |

Year Ended 31st March 2024 |

Year Ended 31st March 2023 |

|

Revenue from Operations |

₹8,491.04 Lakhs |

₹11,817.04 Lakhs |

₹14,788.16 Lakhs |

₹53,202.01 Lakhs |

|

Other Income |

₹355.68 Lakhs |

₹439.49 Lakhs |

₹453.28 Lakhs |

₹1,664.84 Lakhs |

|

Total Income (I + II) |

₹8,846.72 Lakhs |

₹12,256.53 Lakhs |

₹15,241.44 Lakhs |

₹54,866.85 Lakhs |

|

Total Expenses |

₹7,882.80 Lakhs |

₹9,770.47 Lakhs |

₹11,977.28 Lakhs |

₹44,080.43 Lakhs |

|

Profit Before Tax |

₹963.92 Lakhs |

₹2,486.06 Lakhs |

₹3,255.64 Lakhs |

₹10,777.72 Lakhs |

|

Net Profit from Continuing Operations |

₹1,177.98 Lakhs |

₹1,717.22 Lakhs |

₹1,633.64 Lakhs |

₹7,056.06 Lakhs |

|

Net Profit from Discontinued Operations |

(₹6.14) Lakhs |

(₹4.48) Lakhs |

(₹65.95) Lakhs |

(₹88.29) Lakhs |

|

Net Profit for the Period |

₹1,171.84 Lakhs |

₹1,712.74 Lakhs |

₹1,567.69 Lakhs |

₹6,967.77 Lakhs |

|

Earnings per Share (Basic) |

₹1.37 |

₹2.00 |

₹1.90 |

₹8.23 |

|

Earnings per Share (Diluted) |

₹1.37 |

₹2.00 |

₹1.90 |

₹8.23 |

India Tourism Development Stock Performance

The table provides key financial details for the India Tourism Development Corporation (ITDC). It shows that ITDC has a market capitalization of ₹5,903 Crores, meaning this is the total value of all its shares combined. The current stock price is ₹688. The highest price over a certain period was ₹931, and the lowest was ₹370. The Price-to-Earnings (P/E) ratio is 89.9, indicating how expensive the stock is relative to its earnings.

Here's the information in a table format:

|

Metric |

Value |

|

Market Cap |

₹5,903 Cr. |

|

Current Price |

₹688 |

|

High / Low |

₹931 / ₹370 |

|

Stock P/E |

89.9 |

|

Book Value |

₹45.4 |

|

Dividend Yield |

0.37% |

|

ROCE (Return on Capital Employed) |

31.4% |

|

ROE (Return on Equity) |

19.2% |

|

Face Value |

₹10.0 |

Quarterly Results

The table shows financial results for India Tourism Development Corporation (ITDC) over different quarters. In Dec 2023, ITDC had sales of Rs. 135 crores and expenses of Rs. 112 crores, resulting in an operating profit of Rs. 23 crores, which was 17% of sales. By Mar 2024, sales increased to Rs. 148 crores, expenses rose to Rs. 115 crores, and operating profit grew to Rs. 32 crores, with a higher profit margin of 22%.

Here are the financial results for Dec 2023, Mar 2024, and Jun 2024:

|

Metric |

Dec 2023 |

Mar 2024 |

Jun 2024 |

|

Sales (Rs. Crores) |

135 |

148 |

85 |

|

Expenses (Rs. Crores) |

112 |

115 |

77 |

|

Operating Profit (Rs. Crores) |

23 |

32 |

8 |

|

OPM % (Operating Profit Margin) |

17% |

22% |

9% |

|

Other Income (Rs. Crores) |

5 |

4 |

4 |

|

Interest (Rs. Crores) |

0 |

3 |

0 |

|

Depreciation (Rs. Crores) |

2 |

2 |

2 |

|

Profit Before Tax (Rs. Crores) |

25 |

32 |

10 |

|

Tax % |

29% |

51% |

-22% |

|

Net Profit (Rs. Crores) |

18 |

16 |

12 |

|

EPS (Earnings Per Share in Rs.) |

2.10 |

1.83 |

1.38 |

About India Tourism Development Corporation

The India Tourism Development Corporation (ITDC) is a government-run organization established on October 1, 1966. ITDC plays a major role in improving tourism infrastructure in India. Its main goals are to build and manage hotels, offer transportation for tourists, and provide duty-free shopping facilities at seaports. ITDC also provides entertainment options, organizes conventions and conferences, and offers consultancy and training services in tourism and hospitality.

ITDC runs several services to support travelers, including hotels and restaurants at various locations, and it manages tourist transport. The organization is involved in producing and selling tourist information materials. It also operates a division called Ashok Travel & Tours, which handles ticketing, transport, tour packages, and cargo needs. ITDC’s Ashok Institute of Hospitality & Tourism Management provides education and training in tourism and hospitality. Additionally, ITDC manages event services through Ashok Events, handling conferences, exhibitions, and seminars.

With an authorized capital of Rs 150 crores and a paid-up capital of Rs 85.77 crores as of March 31, 2024, ITDC is primarily owned by the Government of India. It has a network that includes hotels, restaurants, and duty-free shops at seaports. To stay relevant, ITDC is expanding into consultancy, training, event management, and tourism projects.

India Tourism Development Corporation Q1 Results - FAQs

1. What is the recent revenue trend for India Tourism Development Corporation?

India Tourism Development Corporation's revenue decreased by 28.15% YoY for the June 2024 quarter.

2. How did India Tourism Development Corporation's operating income change recently?

India Tourism Development Corporation's operating income fell by 69.87% YoY in the June 2024 quarter.

3. What were India Tourism Development Corporation's quarterly earnings per share?

India Tourism Development Corporation's diluted EPS was ₹1.37 for the June 2024 quarter.

4. How did the total expenses of India Tourism Development Corporation change?

India Tourism Development Corporation's total expenses decreased by 19.30% YoY in the June 2024 quarter.

5. What was India Tourism Development Corporation's net income before taxes?

India Tourism Development Corporation's net income before taxes was ₹9.64 crores for the June 2024 quarter.

6. How did India Tourism Development Corporation's net profit compare to last year?

India Tourism Development Corporation's net profit decreased by 32.13% YoY in the June 2024 quarter.

7. What was the quarter-on-quarter revenue drop for India Tourism Development Corporation?

India Tourism Development Corporation's revenue dropped by 42.58% QoQ in the June 2024 quarter.

8. How did India Tourism Development Corporation's selling expenses change in the recent quarter?

India Tourism Development Corporation's selling expenses decreased by 32.58% QoQ in the June 2024 quarter.

9. What was the percentage change in other operating expenses for India Tourism Development Corporation?

India Tourism Development Corporation's other operating expenses decreased by 31.03% QoQ.

10. How did India Tourism Development Corporation's net profit from continuing operations change?

India Tourism Development Corporation's net profit from continuing operations fell to ₹1,177.98 lakhs for June 2024.