- Home »

- Quarterly Results »

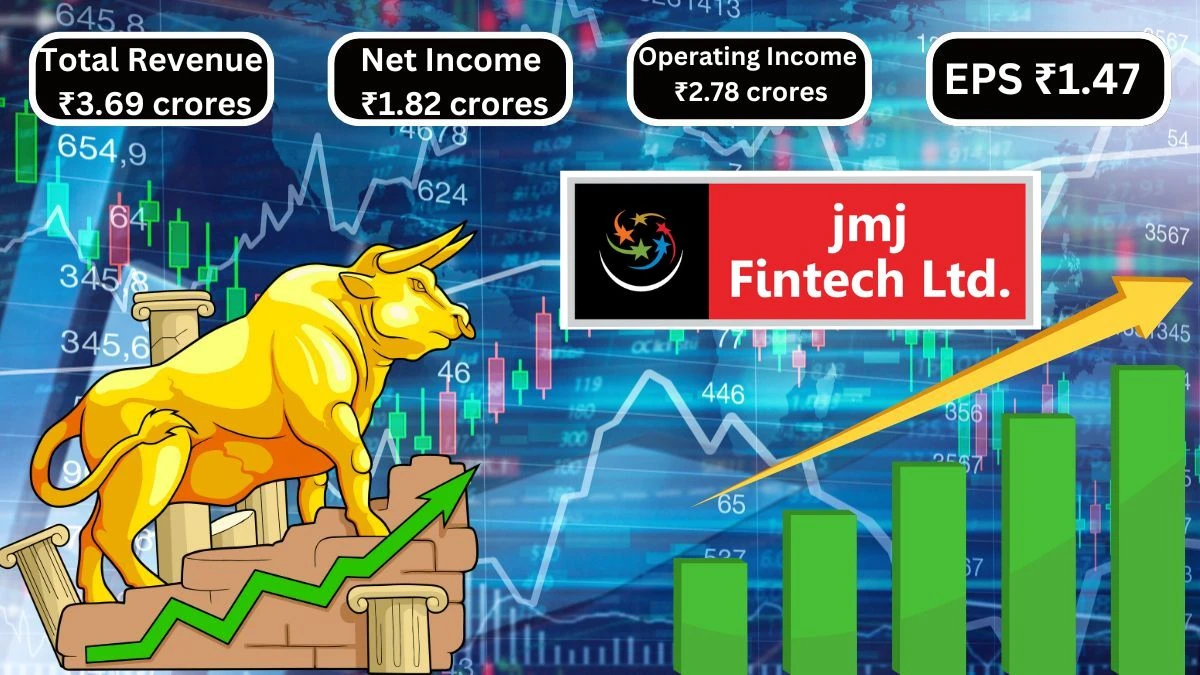

- JMJ Fintech Q1 Results Total Revenue Hits ₹3.69 Crores

JMJ Fintech Q1 Results Total Revenue Hits ₹3.69 Crores

JMJ Fintech Q1 Results show Total Revenue of ₹3.69 crores, up from ₹0.77 crores in the previous quarter and the Net Income increased to ₹1.82 crores, compared to ₹0.16 crores in March 2023.

by Ruksana

Updated Oct 07, 2024

Table of Content

JMJ Fintech Q1 Results: The JMJ Fintech Q1 results show important financial information for the company. The total revenue for June 2024 is ₹3.69 crores, which is a significant increase compared to ₹0.77 crores in March 2023. This represents a positive quarter-on-quarter (QoQ) growth, but we don't have a percentage figure to show the exact change. When we compare year-over-year (YoY), the revenue is slightly higher than the ₹0.78 crores reported in June 2023, showing a stable performance. The selling, general, and administrative expenses totaled ₹0.80 crores in June 2024, up from ₹0.24 crores in the previous quarter. This increase also shows a year-over-year (YoY) rise compared to ₹0.47 crores in June 2023.

JMJ Fintech's income is ₹2.78 crores, a notable increase from ₹0.35 crores in March 2023, reflecting strong quarter-on-quarter (QoQ) growth. The net income before taxes is ₹2.44 crores, which is higher than ₹0.32 crores from the previous quarter. Year-over-year (YoY), the net income is also better than the ₹0.19 crores recorded in June 2023. Overall, JMJ Fintech's performance indicates positive growth and stability in revenue and profits when looking at year-over-year (YoY) and quarter-on-quarter (QoQ) comparisons.

Here are the quarterly results for JMJ Fintech for Q1:

|

Metric |

Jun 24 (Current Quarter) |

Mar 23 (Previous Quarter) |

QoQ Change (%) |

Jun 23 (Same Quarter Last Year) |

YoY Change (%) |

|

Total Revenue |

3.69 |

0.77 |

- |

0.78 |

- |

|

Selling/General/Admin Expenses Total |

0.80 |

0.24 |

- |

0.47 |

- |

|

Depreciation/Amortization |

0.04 |

0.02 |

- |

- |

- |

|

Other Operating Expenses Total |

0.07 |

0.01 |

- |

0.01 |

- |

|

Total Operating Expense |

0.91 |

0.42 |

- |

0.48 |

- |

|

Operating Income |

2.78 |

0.35 |

- |

0.30 |

- |

|

Net Income Before Taxes |

2.44 |

0.32 |

- |

0.19 |

- |

|

Net Income |

1.82 |

0.16 |

- |

0.19 |

- |

|

Diluted Normalized EPS |

1.47 |

0.13 |

- |

0.15 |

- |

Source: Here

For More Q1 Results check our Twitter Page

Visit our website for more Q1 results

JMJ Fintech Q1 Results

JMJ Fintech table presents the financial performance of JMJ Fintech for the quarter ended on June 30, 2024, and compares it with previous periods. The key highlight is Net Sales or Income from Operations, which significantly increased to ₹369.20 Lakhs in the latest quarter, up from ₹78.18 Lakhs in the same quarter last year. This shows strong business growth.

JMJ Fintech’s Total Income from Operations is also notable, showing an increase to ₹369.20 Lakhs compared to ₹78.47 Lakhs a year ago. In terms of expenses, the Total Expenses for the quarter are ₹125.04 Lakhs, which is higher than the ₹59.61 Lakhs from the previous year. The major expenses include Finance Costs and Employee Benefits, indicating that the company is investing in its operations and workforce.

JMJ Fintech Profit before Tax is impressive at ₹244.16 Lakhs, compared to ₹18.86 Lakhs in the same quarter last year. After accounting for taxes, the Profit for the period from Continuing Operations is ₹182.26 Lakhs, showing a significant increase. The Earnings Per Share (EPS), both basic and diluted, is also healthy, reflecting the company's profitability and strong financial health. Overall, JMJ Fintech shows positive growth and performance in its recent financial results.

Here's the financial data you provided:

|

Particulars |

Quarter Ended |

Year Ended |

|

30.06.2024 |

31.03.2024 |

|

|

Net Sales / Income from Operations |

369.20 |

307.50 |

|

Other Operating Income |

0.95 |

0.29 |

|

Total Income from Operations (Net) |

369.20 |

306.55 |

|

Expenses |

||

|

a. Cost of Material Consumed |

- |

- |

|

b. Purchase of Stock-in-Trade |

- |

- |

|

c. Changes in inventories of Finished goods/work in progress & Stock in Trade |

- |

- |

|

d. Finance Cost |

34.11 |

30.59 |

|

e. Employee benefits expenses |

48.26 |

52.20 |

|

f. Depreciation & Amortisation Expense |

4.27 |

18.23 |

|

i. Administrative Expenses |

31.77 |

38.11 |

|

ii. Provision for Non-Performing Assets/Bad debts |

6.63 |

3.71 |

|

iii. Bad debts |

- |

- |

|

Total Expenses |

125.04 |

142.30 |

|

Profit before Exceptional and Extra Ordinary items and Tax (II-IV) |

244.16 |

164.25 |

|

Exceptional items |

- |

- |

|

Profit before Extraordinary items and Tax (V-VI) |

244.16 |

164.25 |

|

Extraordinary Item |

- |

- |

|

Profit Before Tax (VII-VIII) |

244.16 |

164.25 |

|

Tax Expense |

||

|

a. Current Tax |

61.75 |

42.35 |

|

b. Deferred Tax |

0.15 |

- |

|

c. Excess Provision for Tax Written Back |

- |

- |

|

d. Provision for RBI Standard Reserve @ 20% on PBT |

77.15 |

- |

|

Profit/(Loss) for the period from Continuing Operations (IX-X) |

182.26 |

46.22 |

|

Profit/(Loss) from Discontinuing Operations |

- |

- |

|

Tax expense from Discontinuing Operations |

- |

- |

|

Profit/(Loss) from Discontinuing operations (after Tax) |

- |

- |

|

Profit/(Loss) for the period (XI+XIV) |

182.26 |

46.22 |

|

Earning Per Share of Rs. 10/- each (not annualized) |

||

|

a) Basic |

1.47 |

1.03 |

|

b) Diluted |

1.47 |

0.37 |

JMJ Fintech Financial Metrics

The table shows important financial details about JMJ Fintech. The market capitalization is ₹ 35.3 crore, which means this is the total value of the company's shares in the market. The current stock price is ₹ 28.5, with a high of ₹ 40.0 and a low of ₹ 18.0, indicating the price range over a specific period. The Stock P/E ratio is 9.37, suggesting how much investors are willing to pay for each unit of earnings. The book value is ₹ 12.6, representing the company's net asset value per share. The dividend yield is 0.00%, meaning no dividends are paid to shareholders.

Here’s a table summarizing the stock information you provided:

|

Market Cap |

₹ 35.3 Cr. |

|

Current Price |

₹ 28.5 |

|

High / Low |

₹ 40.0 / ₹ 18.0 |

|

Stock P/E |

9.37 |

|

Book Value |

₹ 12.6 |

|

Dividend Yield |

0.00 % |

|

ROCE |

22.7 % |

|

ROE |

15.2 % |

|

Face Value |

₹ 10.0 |

Quarterly Results

The JMJ Fintech table shows the financial performance of the company over several quarters, focusing on key metrics like sales, expenses, operating profit, and net profit. Starting from December 2023, the company had sales of ₹2.14 crores, which increased to ₹3.07 crores in March 2024 and reached ₹3.69 crores by June 2024. The operating profit also grew, indicating improved efficiency and profitability, showing a positive trend from ₹1.50 crores to ₹2.82 crores in the same period.

Here’s the table for the quarterly results for Dec 2023, Mar 2024, and Jun 2024:

|

Particulars |

Dec 2023 |

Mar 2024 |

Jun 2024 |

|

Sales (Rs. Crores) |

2.14 |

3.07 |

3.69 |

|

Expenses (Rs. Crores) |

0.64 |

0.94 |

0.87 |

|

Operating Profit (Rs. Crores) |

1.50 |

2.13 |

2.82 |

|

OPM % |

70.09% |

69.38% |

76.42% |

|

Other Income (Rs. Crores) |

0.00 |

0.00 |

0.00 |

|

Interest (Rs. Crores) |

0.25 |

0.31 |

0.34 |

|

Depreciation (Rs. Crores) |

0.00 |

0.18 |

0.04 |

|

Profit Before Tax (Rs. Crores) |

1.25 |

1.64 |

2.44 |

|

Tax % |

17.60% |

72.56% |

25.41% |

|

Net Profit (Rs. Crores) |

1.03 |

0.46 |

1.82 |

|

EPS in Rs |

0.83 |

0.37 |

1.47 |

About JMJ Fintech

JMJ Fintech is a registered non-deposit-taking Non-Banking Financial Company (NBFC) located in Ganapathy, Coimbatore, Tamil Nadu. Established on November 27, 1982, the company was formerly known as Meenakshi Enterprises. With over 40 years of experience, JMJ Fintech focuses on providing financial services primarily to corporate clients and high-net-worth individuals. They follow strong ethical principles, which guide their operations and the products they offer.

JMJ Fintech is known for its innovative approach to lending, which contributes to a more accessible money-lending environment in India. They offer loans secured against various forms of collateral, such as shares and bank guarantees, with a commitment to ensuring that they have no bad debts, which highlights their effective business model. They also understand the importance of supporting small and medium enterprises (SMEs) by offering loans tailored to the unique needs of business owners in this sector.

JMJ Fintech Q1 Results - FAQs

1. What was JMJ Fintech's total revenue for June 2024?

JMJ Fintech's total revenue for June 2024 was ₹3.69 crores.

2. How much did JMJ Fintech earn in net income before taxes in Q1 2024?

JMJ Fintech earned ₹2.44 crores in net income before taxes in Q1 2024.

3. What were the selling, general, and administrative expenses for JMJ Fintech in June 2024?

JMJ Fintech's selling, general, and administrative expenses totaled ₹0.80 crores in June 2024.

4. What is the year-over-year revenue growth for JMJ Fintech comparing June 2024 to June 2023?

JMJ Fintech's revenue in June 2024 was slightly higher than ₹0.78 crores reported in June 2023.

5. How much did JMJ Fintech's profit before tax increase from March 2024 to June 2024?

JMJ Fintech's profit before tax increased from ₹1.64 crores in March 2024 to ₹2.44 crores in June 2024.

6. What were JMJ Fintech's total expenses for the quarter ended June 2024?

JMJ Fintech's total expenses for the quarter ended June 2024 were ₹125.04 lakhs.

7. What was JMJ Fintech's profit for the period from continuing operations in June 2024?

JMJ Fintech's profit for the period from continuing operations was ₹182.26 lakhs in June 2024.

8. How much did JMJ Fintech spend on finance costs in Q1 2024?

JMJ Fintech spent ₹34.11 lakhs on finance costs in Q1 2024.

9. What was JMJ Fintech's operating income for the quarter ended June 2024?

JMJ Fintech's operating income for the quarter ended June 2024 was ₹2.78 crores.

10. How did JMJ Fintech's total income from operations compare year-over-year?

JMJ Fintech's total income from operations increased to ₹369.20 lakhs compared to ₹78.47 lakhs a year ago.