- Home »

- Quarterly Results »

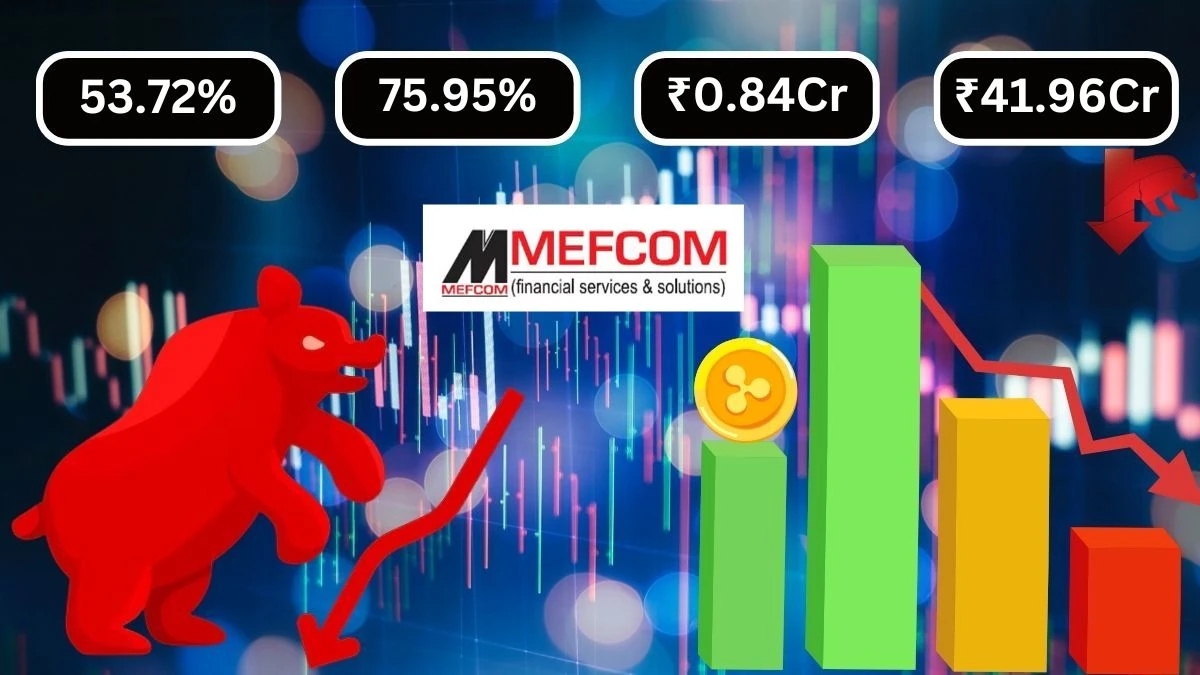

- Mefcom Capital Markets Q1 Results Revenue Falls 53.72% QoQ but Rises 75.95% YoY

Mefcom Capital Markets Q1 Results Revenue Falls 53.72% QoQ but Rises 75.95% YoY

Mefcom Capital Markets Q1 Results with total revenue was ₹41.96 crores, showing a 75.95% increase YoY but a 53.72% decrease QoQ and Operating income fell by 48.98% YoY to ₹0.91 crores, and net income dropped by 53.56% YoY to ₹0.84 crores.

by Ruksana

Updated Sep 06, 2024

Table of Content

Mefcom Capital Markets Growth Comparison

Mefcom Capital Markets Q1 Results: Mefcom Capital Markets' Q1 results show some interesting changes. For the quarter ending in June 2024 (Jun 24), the company earned ₹41.96 crores in total revenue, which is a big increase from ₹23.84 crores last year (YoY, year-over-year). However, compared to the previous quarter (Mar 23), where the revenue was ₹8.93 crores, there is a significant drop of 53.72% (QoQ, quarter-on-quarter).

Mefcom Capital Markets' Selling, general, and administrative expenses increased to ₹0.16 crores from ₹0.14 crores last year, showing a 19.05% rise YoY. This increase was more noticeable compared to the previous quarter’s expenses of ₹0.11 crores, which rose by 61.76% QoQ. Depreciation and amortization costs remained steady at ₹0.02 crores for all periods, but they slightly increased by 22.31% QoQ and decreased by 4.79% YoY.

Mefcom Capital Markets' Total operating expenses surged to ₹41.05 crores from ₹22.06 crores last year (YoY), and this is a 54.02% rise compared to the previous quarter. Operating income decreased to ₹0.91 crores from ₹1.78 crores last year (YoY) and was less than the negative ₹1.91 crores in the previous quarter. Net income also fell to ₹0.84 crores from ₹1.80 crores last year and from the negative ₹1.71 crores in the previous quarter. The diluted normalized EPS dropped to ₹0.18 from ₹0.39 last year, reflecting a decline YoY and QoQ.

Here’s a summary of Mefcom Capital Markets' Q1 results:

(All figures in crores except per share values)

|

Metric |

Jun 24 |

Mar 23 |

QoQ Change |

Jun 23 |

YoY Change |

|

Total Revenue |

41.96 |

8.93 |

-53.72% |

23.84 |

75.95% |

|

Selling/General/Admin Expenses |

0.16 |

0.11 |

61.76% |

0.14 |

19.05% |

|

Depreciation/Amortization |

0.02 |

0.02 |

22.31% |

0.02 |

-4.79% |

|

Other Operating Expenses |

0.32 |

0.23 |

-35.37% |

0.26 |

20.51% |

|

Total Operating Expense |

41.05 |

10.83 |

-54.02% |

22.06 |

86.05% |

|

Operating Income |

0.91 |

-1.91 |

-33.83% |

1.78 |

-48.98% |

|

Net Income Before Taxes |

0.91 |

-1.83 |

-36.00% |

1.83 |

-50.22% |

|

Net Income |

0.84 |

-1.71 |

-23.67% |

1.80 |

-53.56% |

|

Diluted Normalized EPS |

0.18 |

-0.37 |

-25.00% |

0.39 |

-54.31% |

Source: Here

For More Q1 Results check our Twitter Page

Visit our website for more Q1 results

Mefcom Capital Markets Q1 Results

The Mefcom Capital Markets table shows financial performance for different periods. For the quarter ending on June 30, 2024, the company reported a revenue from operations of 3,569.48 million. This is a decrease from the 8,375.73 million reported for the year ending March 31, 2024. The other income for the quarter was just 0.20 million, a significant drop from 4.14 million in the previous year. Combined, these numbers gave a total income of 3,569.69 million for the quarter, compared to 8,379.87 million for the previous year.

Looking at the expenses, Mefcom Capital Markets had various costs, including changes in inventories which increased to 4,134.36 million in the quarter, up from 7,337.54 million in the previous year. Employee benefit expenses showed a negative figure of (677.54) million, meaning the company had a reduction in these costs compared to the previous year’s 872.67 million. The finance cost was 12.17 million, slightly higher than the 5.72 million reported earlier. Depreciation and amortization expenses decreased to 1.87 million from 17.65 million, and other expenses remained minimal at 1.32 million.

Mefcom Capital Markets After accounting for these expenses, the company had a profit before tax of 72.29 million for the quarter. This is a decrease from 105.29 million in the previous year. The total tax expenses for the quarter were 72.29 million, compared to 18.04 million in the previous year. The company’s net profit for the quarter was 87.25 million, which is significantly lower compared to 672.38 million from the previous year.

In terms of equity, Mefcom Capital Markets had a paid-up share capital of 63.99 million, lower than the 80.81 million reported previously. The earnings per share, which shows how much profit each share earns, were 0.16 for both basic and diluted shares, compared to 0.19 in the previous year.

Here’s a simplified summary of the financial results:

|

Sr. No. |

Particulars |

30-Jun-24 (Un-Audited) |

31-Mar-24 (Audited) |

30-Jun-23 (Un-Audited) |

Year Ended 31-Mar-24 (Audited) |

|

I |

Revenue from operation |

3,569.48 |

8,375.73 |

2,368.03 |

21,752.73 |

|

II |

Other Income |

0.20 |

4.14 |

4.50 |

40.68 |

|

III |

Total Income |

3,569.69 |

8,379.87 |

2,372.53 |

21,793.41 |

|

IV |

Expenses |

||||

|

a) Purchases of stock-in-trade |

|||||

|

b) Changes in inventories of stock-in-trade |

4,134.36 |

7,337.54 |

1,636.51 |

21,170.41 |

|

|

c) Employees benefit expenses |

(677.54) |

872.67 |

513.64 |

(291.46) |

|

|

d) Finance cost |

12.17 |

5.72 |

9.10 |

26.97 |

|

|

e) Depreciation and amortization expense |

1.87 |

17.65 |

14.96 |

62.07 |

|

|

f) Other expenses |

1.32 |

1.26 |

1.67 |

6.97 |

|

|

Total Expenses |

3,497.40 |

8,274.58 |

2,197.07 |

21,102.99 |

|

|

V |

Profit/(loss) before exceptional items and tax |

72.29 |

105.29 |

175.47 |

690.42 |

|

VI |

Exceptional items |

||||

|

VII |

Profit/(loss) before tax |

72.29 |

105.29 |

175.47 |

690.42 |

|

VIII |

Tax expenses |

||||

|

a) Current tax |

18.04 |

18.04 |

|||

|

b) Deferred tax |

|||||

|

c) Income Tax Earlier Years |

|||||

|

Total Tax expenses |

72.29 |

18.04 |

175.47 |

18.04 |

|

|

IX |

Profit/(loss) for the period |

87.25 |

672.38 |

||

|

X |

Other Comprehensive Income (net of tax) |

||||

|

(i) Items that will not be reclassified to profit or loss |

|||||

|

(ii) Income tax relating to items that will not be reclassified to profit or loss |

(8.30) |

(6.44) |

234.89 |

140.44 |

|

|

XI |

Total Comprehensive Income for the period |

||||

|

XII |

Paid up Equity Share Capital (Face value of Rs 2/- per share) |

63.99 |

80.81 |

410.36 |

812.82 |

|

XIII |

Reserves (excluding Revaluation Reserve) |

||||

|

XIV |

Earnings per equity share (Face value of Rs 2/- each) (not annualised) |

||||

|

1) Basic |

0.16 |

0.19 |

0.38 |

1.47 |

|

|

2) Diluted |

0.16 |

0.19 |

0.38 |

1.47 |

Mefcom Capital Markets Stock Performance

The Mefcom Capital Markets table provides key financial details about the company. The market capitalization is ₹79.0 Crores, indicating the total value of all its shares. The current share price is ₹17.3. The highest price over a period was ₹26.0, while the lowest was ₹10.4. The Price-to-Earnings (P/E) ratio is 11.6, showing how much investors are willing to pay per unit of earnings. The book value per share is ₹4.93, representing the company's net worth per share.

Here's the information in table format:

|

Metric |

Value |

|

Market Cap |

₹79.0 Cr. |

|

Current Price |

₹17.3 |

|

High / Low |

₹26.0 / ₹10.4 |

|

Stock P/E |

11.6 |

|

Book Value |

₹4.93 |

|

Dividend Yield |

0.00% |

|

ROCE |

41.1% |

|

ROE |

43.3% |

|

Face Value |

₹2.00 |

Quarterly Results

For Mefcom Capital Markets, the financial results for December 2023, March 2024, and June 2024 show some important trends. In December 2023, the company had strong sales of Rs. 67.76 Crores and a good profit of Rs. 3.63 Crores, with a high operating profit margin of 5.46%. By March 2024, sales grew to Rs. 90.65 Crores, but operating profit dropped to Rs. 1.57 Crores, showing a lower margin of 1.73%. In June 2024, sales decreased to Rs. 41.96 Crores, and the company made a smaller profit of Rs. 0.95 Crores, with a slight margin increase to 2.26%.

Here's the table for the quarters December 2023, March 2024, and June 2024:

|

Particulars |

Dec 2023 |

Mar 2024 |

Jun 2024 |

|

Sales |

67.76 |

90.65 |

41.96 |

|

Expenses |

64.06 |

89.08 |

41.01 |

|

Operating Profit |

3.70 |

1.57 |

0.95 |

|

OPM % |

5.46% |

1.73% |

2.26% |

|

Other Income |

0.11 |

0.05 |

0.00 |

|

Interest |

0.16 |

0.18 |

0.02 |

|

Depreciation |

0.02 |

0.01 |

0.02 |

|

Profit Before Tax |

3.63 |

1.43 |

0.91 |

|

Tax % |

0.00% |

12.59% |

0.00% |

|

Net Profit |

3.63 |

1.25 |

0.92 |

|

EPS in Rs |

0.74 |

0.24 |

0.18 |

About Mefcom Capital Markets

MEFCOM Capital Markets founded in 1985 by Mr. Vijay Mehta, is a leading financial services company based in India. Over the years, it has built a strong reputation in the financial industry. The company offers a wide range of services, including investment banking, corporate advisory, mergers and acquisitions, and trading in equities, derivatives, and commodities. MEFCOM Capital Markets is known for its expertise in handling IPOs and rights issues, having managed over 250 such deals and raised more than INR 25,000 million in the Indian capital markets.

MEFCOM Capital Markets is part of a larger group with several subsidiaries. MEFCOM Securities is a corporate member of major stock exchanges like BSE, NSE, and DSE, while MEFCOM Commodity Brokers is involved in commodity trading on platforms like NMCEI and MCX. MEFCOM Global Enterprise, based overseas, focuses on commodities arbitrage and futures trading.

With its corporate headquarters in New Delhi and offices across India and abroad, MEFCOM Capital Markets is dedicated to providing high-quality, ethical financial services. The company prides itself on its strong research capabilities and commitment to client satisfaction.

Mefcom Capital Markets Q1 Results - FAQs

1. What were the total revenues for Mefcom Capital Markets in Q1 2024?

Mefcom Capital Markets reported total revenues of ₹41.96 crores for Q1 2024.

2. How did Mefcom Capital Markets’ Q1 2024 revenue compare to Q4 2023?

Mefcom Capital Markets' Q1 2024 revenue decreased by 53.72% from ₹8.93 crores in Q4 2023.

3. What were the selling expenses for Mefcom Capital Markets in Q1 2024?

Mefcom Capital Markets' selling expenses were ₹0.16 crores in Q1 2024.

4. How did Mefcom Capital Markets’ operating income change from Q1 2023 to Q1 2024?

Mefcom Capital Markets' operating income decreased by 48.98% from ₹1.78 crores in Q1 2023 to ₹0.91 crores in Q1 2024.

5. What was the net income for Mefcom Capital Markets in Q1 2024?

Mefcom Capital Markets’ net income in Q1 2024 was ₹0.84 crores.

6. How did Mefcom Capital Markets’ total operating expenses change in Q1 2024?

Mefcom Capital Markets’ total operating expenses surged by 54.02% to ₹41.05 crores in Q1 2024.

7. What was Mefcom Capital Markets’ profit before tax for Q1 2024?

Mefcom Capital Markets reported a profit before tax of ₹72.29 million in Q1 2024.

8. How did Mefcom Capital Markets' other income in Q1 2024 compare to the previous year?

Mefcom Capital Markets' other income dropped to ₹0.20 million in Q1 2024 from ₹4.50 million in the previous year.

9. How did Mefcom Capital Markets' net profit in Q1 2024 compare to the previous year?

Mefcom Capital Markets’ net profit in Q1 2024 was ₹87.25 million, significantly lower than ₹672.38 million in the previous year.

10. What were Mefcom Capital Markets’ total expenses in Q1 2024?

Mefcom Capital Markets' total expenses for Q1 2024 were ₹3,497.40 million.