- Home »

- Quarterly Results »

- Shardul Securities Q1 Results Reflect Significant Progress

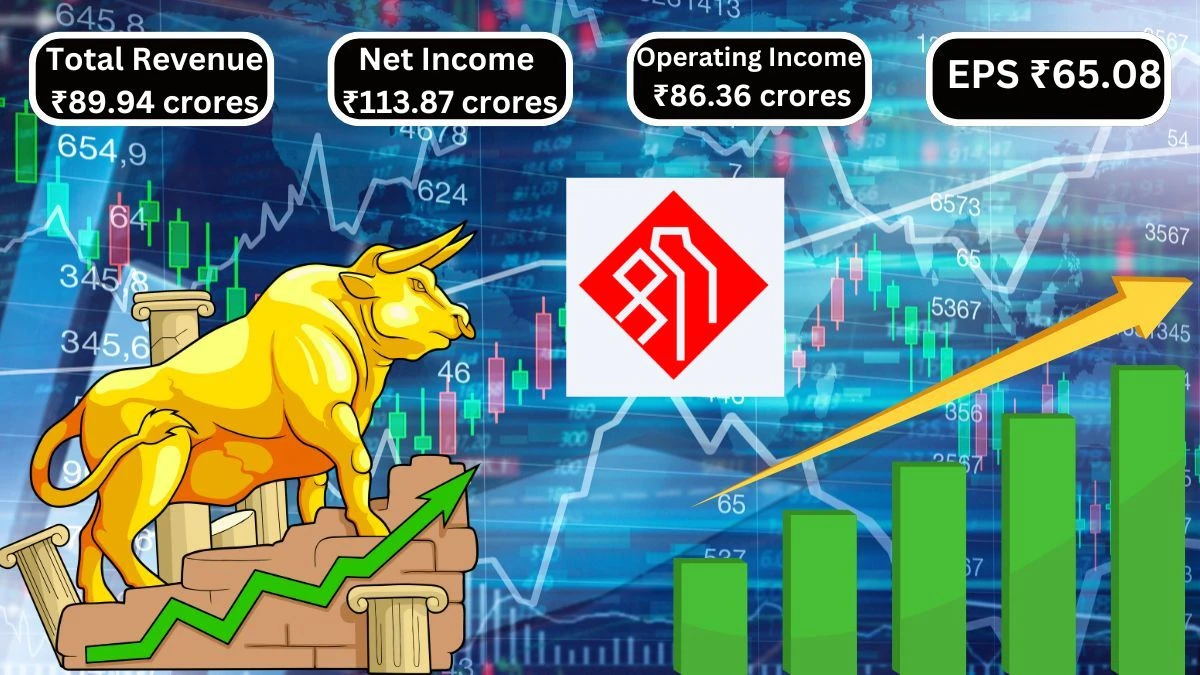

Shardul Securities Q1 Results Reflect Significant Progress

Shardul Securities Q1 Results with Total Revenue reaching ₹89.94 crores, a significant increase from ₹30.00 crores last year and Net Income also rose to ₹113.87 crores, up from ₹22.98 crores in the same quarter last year.

by Ruksana

Updated Oct 04, 2024

Table of Content

Shardul Securities Q1 Results: The table presents the financial results for Shardul Securities for the first quarter of the fiscal year 2024 (Jun 24). It shows several important metrics that help understand the company’s performance. First, the Total Revenue is ₹89.94 crores, which is significantly higher than ₹30.00 crores from the same quarter last year (YoY). This shows strong growth in revenue year-over-year (YoY). The Operating Income is ₹86.36 crores, up from ₹28.54 crores in the same quarter last year, indicating an impressive increase year-over-year (YoY).

Shardul Securities’ Net Income also reflects a positive trend, reaching ₹113.87 crores, compared to ₹22.98 crores in Jun 23, which is a significant improvement year-over-year (YoY). The Diluted Normalized EPS (Earnings Per Share) has risen to ₹65.08, compared to ₹13.13 last year, showing a robust year-over-year (YoY) increase.

Shardul Securities’ Total Revenue has changed from a negative figure of -₹3.62 crores in Mar 23 to a positive ₹89.94 crores in Jun 24, indicating a strong recovery. Overall, Shardul Securities demonstrates significant growth, especially when comparing year-over-year (YoY) results.

Here are the quarterly results for Shardul Securities for Q1, presented in a clear table format:

(All figures in crores except per share values)

|

Metric |

Jun 24 |

Mar 23 |

QoQ Comp (%) |

Jun 23 |

YoY Comp (%) |

|

Total Revenue |

89.94 |

-3.62 |

- |

30.00 |

- |

|

Selling/General/Admin Expenses |

1.78 |

0.33 |

- |

0.43 |

- |

|

Depreciation/Amortization |

0.11 |

0.09 |

- |

0.10 |

- |

|

Other Operating Expenses |

1.70 |

0.78 |

- |

0.93 |

- |

|

Total Operating Expense |

3.58 |

1.20 |

- |

1.46 |

- |

|

Operating Income |

86.36 |

-4.82 |

- |

28.54 |

- |

|

Net Income Before Taxes |

136.38 |

-5.67 |

- |

28.98 |

- |

|

Net Income |

113.87 |

-4.69 |

- |

22.98 |

- |

|

Diluted Normalized EPS |

65.08 |

-2.68 |

- |

13.13 |

- |

Source: Here

For More Q1 Results check our Twitter Page

Visit our website for more Q1 results

Shardul Securities Q1 Results

Shardul Securities’ financial results for Shardul Securities for the quarter ending June 30, 2024, show significant growth compared to the same period last year. The company earned a total revenue from operations of ₹11,529.08 lakhs, which is a big increase from ₹4,676.91 lakhs in the previous year. This rise is mainly due to a substantial net gain on fair value changes of ₹6,565.10 lakhs and profit from selling investments. While the company faced a slight loss from dealing in securities, overall revenue was strong.

Shardul Securities’ Total income, which includes other sources like interest and dividends, reached ₹11,529.14 lakhs, indicating effective management of diverse income streams. On the expense side, total expenses were ₹295.80 lakhs, which is lower than last year's ₹357.48 lakhs, showing better cost control. After deducting taxes, Shardul Securities reported a net profit of ₹9,390.23 lakhs, a remarkable increase compared to ₹1,650.75 lakhs in the same quarter last year. This success also reflects in their comprehensive income, which takes into account additional earnings not included in net profit, amounting to ₹4,582.07 lakhs. Overall, these results highlight the company’s strong performance and effective financial strategies, positioning it well for future growth.

Here’s a simplified presentation of the standalone financial results for the quarter ended June 30, 2024, in tabular format.

(Rs. In Lakhs, except earning per share data)

|

Particulars |

Quarter Ended 31-Mar-24 (Unaudited) |

Quarter Ended 30-Jun-23 (Unaudited) |

Year Ended 30-Jun-24 (Audited) |

Year Ended 31-Mar-24 (Audited) |

|

Revenue From Operations |

||||

|

Interest Income |

1.16 |

3.73 |

0.14 |

6.20 |

|

Dividend Income |

42.42 |

120.41 |

8.89 |

315.77 |

|

Rent Income |

45.84 |

40.65 |

12.15 |

100.85 |

|

Net Gain on Fair Value Changes |

6,565.10 |

3,292.34 |

968.92 |

6,056.76 |

|

Profit/ (Loss) on dealing in Securities (Net) |

(4.83) |

894.75 |

1,843.01 |

7,859.61 |

|

Net Profit/ (Loss) on Sale of Investments |

4,879.39 |

325.03 |

39.91 |

1,628.99 |

|

Total Revenue From Operations (A) |

11,529.08 |

4,676.91 |

2,873.02 |

15,968.18 |

|

Other Income (B) |

0.06 |

77.67 |

0.13 |

79.25 |

|

Total Income (C=A+B) |

11,529.14 |

4,754.58 |

2,873.15 |

16,047.43 |

|

Expenses |

||||

|

Finance Costs |

21.76 |

22.79 |

37.67 |

|

|

Employee Benefits Expenses |

21.99 |

21.81 |

14.84 |

82.76 |

|

Depreciation and Amortisation Expenses |

7.41 |

7.38 |

6.82 |

27.77 |

|

Securities Transaction Tax |

132.29 |

162.53 |

18.44 |

284.30 |

|

Donation |

40.00 |

86.01 |

50.00 |

160.51 |

|

Other Expenses |

72.35 |

56.96 |

17.67 |

252.00 |

|

Total Expenses (D) |

295.80 |

357.48 |

107.77 |

845.01 |

|

Profit/ (Loss) before Tax (E=C-D) |

11,233.34 |

4,397.10 |

2,765.38 |

15,202.42 |

|

Tax Expense |

||||

|

Current Tax |

1,365.00 |

2,485.00 |

435.00 |

5,475.00 |

|

Adjustment of Current Tax Relating to Prior Years |

478.11 |

261.35 |

139.88 |

7.65 |

|

Deferred Tax |

300.52 |

|||

|

Total Tax Expense (F) |

1,843.11 |

2,746.35 |

574.88 |

5,783.17 |

|

Profit/ (Loss) for the period (G=E-F) |

9,390.23 |

1,650.75 |

2,190.50 |

9,419.25 |

|

Other Comprehensive Income |

||||

|

(a) Items that will not be reclassified to Profit or Loss |

3,009.25 |

2,577.61 |

8,254.49 |

|

|

(b) Income Tax relating to above |

1,572.82 |

(212.79) |

1,405.15 |

|

|

Items that will not be reclassified to Profit or Loss net of tax |

4,582.07 |

2,364.82 |

9,659.64 |

|

|

Items that will be reclassified to Profit or Loss net of tax |

||||

|

Total Other Comprehensive Income (H) |

4,582.07 |

2,364.82 |

9,659.64 |

|

|

Total Comprehensive Income for the period (I=G+H) |

9,390.23 |

6,232.82 |

4,555.32 |

19,078.89 |

|

(Comprising Profit/ (Loss) and Other Comprehensive Income) |

||||

|

Paid up Equity Share Capital (Face Value of Rs. 10 per share) |

1,749.84 |

1,749.84 |

1,749.84 |

1,749.84 |

|

Other Equity |

53,516.06 |

|||

|

Earnings per equity share of face value of Rs. 10/- each (not annualised for the interim periods) |

||||

|

(a) Basic (In Rs.) |

53.66 |

9.43 |

12.52 |

53.83 |

|

(b) Diluted (In Rs.) |

53.66 |

9.43 |

12.52 |

53.83 |

Shardul Securities Financial Metrics

The table about Shardul Securities provides key financial information about the company. Its market capitalization is ₹733 crore, showing its total value in the stock market. The current price of the stock is ₹419, with a highest price of ₹442 and a lowest price of ₹100 over a certain period. The Price-to-Earnings (P/E) ratio is 3.89, indicating how much investors are willing to pay for each unit of earnings. The book value is ₹384, representing the company's net asset value per share.

Here’s a summary of the financial information you provided in a table format:

|

Financial Metric |

Value |

|

Market Cap |

₹ 733 Cr. |

|

Current Price |

₹ 419 |

|

High / Low |

₹ 442 / ₹ 100 |

|

Stock P/E |

3.89 |

|

Book Value |

₹ 384 |

|

Dividend Yield |

0.00 % |

|

ROCE |

28.9 % |

|

ROE |

17.4 % |

|

Face Value |

₹ 10.0 |

Quarterly Results

Shardul Securities showed strong performance in its quarterly results for December 2023, March 2024, and June 2024. In December 2023, the company recorded sales of 59 crores and a net profit of 41 crores, with an impressive operating profit margin of 97%. By March 2024, sales slightly decreased to 54 crores, leading to a net profit of 16 crores and an operating profit margin of 92%. However, in June 2024, the company rebounded significantly, achieving sales of 140 crores and a net profit of 114 crores, along with an operating profit margin of 98%.

Here are the consolidated quarterly results for December 2023, March 2024, and June 2024:

(Consolidated Figures in Rs. Crores)

|

Particulars |

Dec 2023 |

Mar 2024 |

Jun 2024 |

|

Sales |

59 |

54 |

140 |

|

Expenses |

2 |

4 |

3 |

|

Operating Profit |

57 |

49 |

137 |

|

OPM (%) |

97% |

92% |

98% |

|

Other Income |

0 |

1 |

0 |

|

Interest |

0 |

0 |

0 |

|

Depreciation |

0 |

0 |

0 |

|

Profit Before Tax |

57 |

50 |

136 |

|

Tax (%) |

28% |

68% |

17% |

|

Net Profit |

41 |

16 |

114 |

|

EPS (Rs) |

23.41 |

9.21 |

65.07 |

About Shardul Securities

Shardul Securities, formerly known as Shriyam Securities & Finance, is an important company in the finance sector. It was started by a team of young Chartered Accountants who have a lot of experience in finance. The company initially focused on helping manufacturing and service industries by providing lease finance. However, due to changes in policies, it shifted its focus to investment banking. Now, Shardul Securities is involved in various activities, including equity and debt investments, merchant banking, IPO funding, and advisory services. They also operate a subsidiary called Shiryam Broking Intermediary, which focuses on broking services.

Shardul Securities is registered as a Non-Banking Financial Company (NBFC) with the Reserve Bank of India and is listed on the Bombay Stock Exchange. Its office is located in Mumbai, the heart of financial activities in India, and it has branches in several other major cities like Delhi, Bangalore, Ahmedabad, and Pune. Shardul Securities is dedicated to increasing shareholder value while maintaining high standards in investment banking. They serve a diverse clientele, including banks, financial institutions, corporations, and high net worth individuals, ensuring a wide reach in the financial market.

Shardul Securities Q1 Results - FAQs

1. What is the Total Revenue of Shardul Securities for Q1 FY 2024?

The Total Revenue of Shardul Securities for Q1 FY 2024 is ₹89.94 crores.

2. How much did Shardul Securities earn in Net Income for Q1 FY 2024?

Shardul Securities reported a Net Income of ₹113.87 crores for Q1 FY 2024.

3. How did Shardul Securities’ Total Revenue in Q1 FY 2024 compare to the previous year?

Shardul Securities’ Total Revenue increased from ₹30.00 crores last year to ₹89.94 crores this year.

4. What is Shardul Securities' Market Capitalization?

The Market Capitalization of Shardul Securities is ₹733 crores.

5. What was Shardul Securities’ Total Operating Income for Q1 FY 2024?

Shardul Securities’ Total Operating Income for Q1 FY 2024 is ₹86.36 crores.

6. What were the total expenses for Shardul Securities in Q1 FY 2024?

The total expenses for Shardul Securities in Q1 FY 2024 were ₹3.58 crores.

7. What is the Dividend Yield of Shardul Securities?

The Dividend Yield of Shardul Securities is 0.00%.

8. What was the Profit Before Tax for Shardul Securities in Q1 FY 2024?

The Profit Before Tax for Shardul Securities in Q1 FY 2024 is ₹136.38 crores.

9. How did Shardul Securities’ Net Profit for Q1 FY 2024 compare to last year?

Shardul Securities’ Net Profit increased significantly from ₹22.98 crores last year to ₹113.87 crores this year.

10. How much did Shardul Securities report in Comprehensive Income for the period?

Shardul Securities reported a Total Comprehensive Income of ₹9,390.23 lakhs for the period.