- Home »

- Quarterly Results »

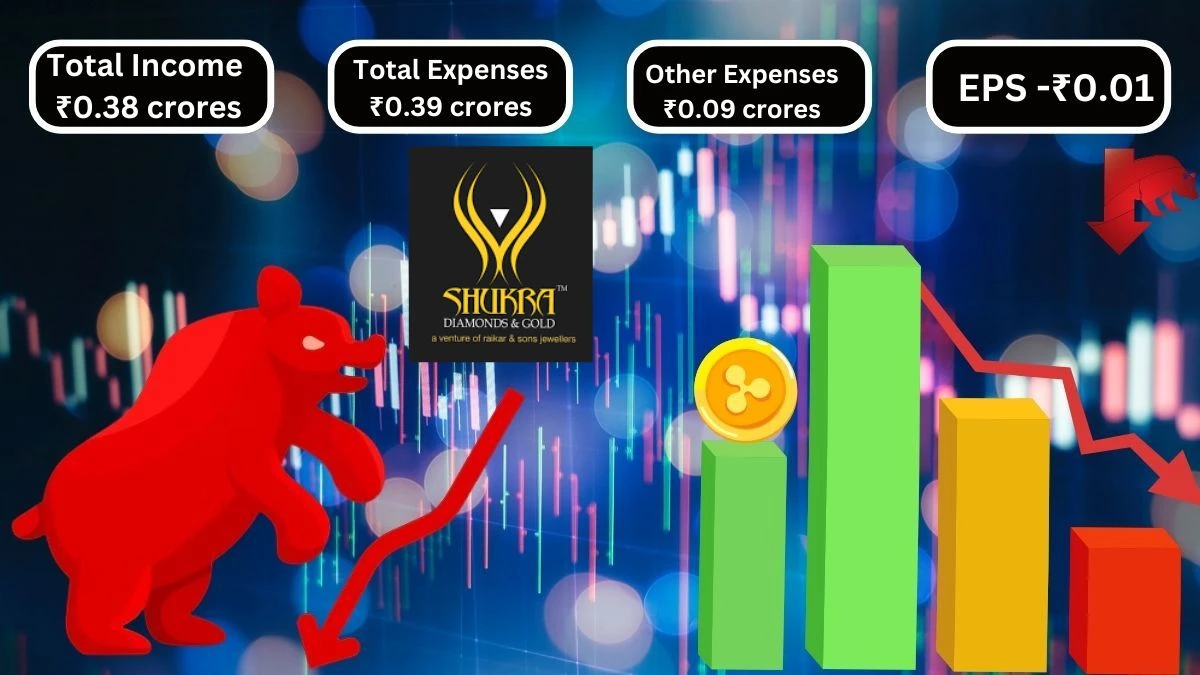

- Sukra Jewellery Q1 Results Shortfall with Total Income of ₹0.38 crores & Total Expenses ₹0.39 crores

Sukra Jewellery Q1 Results Shortfall with Total Income of ₹0.38 crores & Total Expenses ₹0.39 crores

Sukra Jewellery Q1 Results reported a Total Income of ₹0.38 crores for Q1 2024, a significant drop from ₹3.13 crores in the previous quarter and they faced Total Expenses of ₹0.39 crores, resulting in a loss before tax of ₹0.09 crores.

by Ruksana

Updated Sep 25, 2024

Table of Content

Sukra Jewellery Q1 Results

Sukra Jewellery Q1 Results: Sukra Jewellery has released its consolidated audited financial results for the quarter that ended on June 30, 2024. They reported total income from operations of ₹38.00 lakhs, which is a decrease compared to ₹313.12 lakhs from the previous quarter. This decline is mainly due to a drop in net sales. On the expenses side, the total expenses increased to ₹38.90 lakhs from ₹301.70 lakhs in the last quarter, influenced by the cost of stock purchases and changes in inventory. Despite this increase, the company faced a loss before tax of ₹0.90 lakhs, compared to a profit of ₹11.42 lakhs in the previous quarter.

Sukra Jewellery’s net loss for the period from continuing operations was ₹0.90 lakhs, indicating that the company struggled to maintain profitability during this quarter. Additionally, the total comprehensive income, which includes other income and expenses, was negative at ₹-2.00 lakhs. This means the overall financial health of Sukra Jewellery has weakened in this quarter. The earnings per share also reflected this downturn, showing a basic and diluted loss of ₹-0.01 per share. Overall, these results suggest that Sukra Jewellery is facing challenges in its operations.

Here’s a simplified summary of the consolidated audited financial results for the quarter ended June 30, 2024:

(in Rs. Lakhs)

|

Particulars |

Quarter Ended |

Year Ended |

|

30.06.24 |

31.03.24 |

|

|

1. Income from Operations |

||

|

(a) Net sales/income from operations |

38.00 |

31046 |

|

(b) Other Operating Income |

- |

2.66 |

|

Total Income from Operations (net) |

38.00 |

313.12 |

|

2. Expenses |

||

|

(a) Cost of materials consumed |

- |

- |

|

(b) Purchases of stock-in-trade |

277.40 |

451.18 |

|

(c) Changes in inventories |

-239.40 |

-159.19 |

|

(d) Employee benefits expenses |

2.00 |

3.42 |

|

(e) Finance Cost |

- |

0.04 |

|

(f) Depreciation and amortisation expenses |

- |

1.91 |

|

(g) Other expenses |

0.90 |

7.76 |

|

Total Expenses |

38.90 |

301.70 |

|

3. Profit/(Loss) before exceptional items and tax |

0.90 |

11.42 |

|

4. Exceptional Items |

- |

- |

|

5. Profit/(Loss) before tax |

-0.90 |

11.42 |

|

6. Tax Expenses |

||

|

(a) Current Tax |

- |

138 |

|

(b) Deferred Tax |

- |

165 |

|

7. Profit/(Loss) for the period from continuing operations |

-0.90 |

8.39 |

|

8. Profit/(Loss) from discontinued operations |

-0.90 |

8.39 |

|

9. Other Comprehensive Income/(Loss) |

||

|

(A)(i) Items not reclassified |

- |

- |

|

(A)(ii) Tax on items not reclassified |

- |

- |

|

(B)(i) Items reclassified |

-1.10 |

13.77 |

|

(B)(ii) Tax on items reclassified |

- |

- |

|

10. Total Comprehensive Income for the period |

-2.00 |

22.16 |

|

11. Equity Shares |

||

|

(i) No. of equity shares |

135.73 |

135.73 |

|

(ii) Reserves excluding revaluation reserves |

||

|

12. Earnings Per Share (Rs.) |

||

|

(a) Basic |

-0.01 |

0.06 |

|

(b) Diluted |

-0.01 |

0.06 |

Source: Here

For More Q1 Results check our Twitter Page

Visit our website for more Q1 result

Sukra Jewellery Financial Metrics

Sukra Jewellery with a market capitalization of ₹11.8 crores, meaning it is valued at this amount in the stock market. The current stock price is ₹8.70, which shows what investors pay for a share. The stock has seen a high of ₹11.60 and a low of ₹3.20 in the past, indicating some price fluctuations. Its book value is ₹27.10, which is the value of its assets minus liabilities. The company does not offer dividends, as the yield is 0.00%. The return on capital employed (ROCE) is 0.25%, and the return on equity (ROE) is 0.17%, reflecting its profitability and efficiency.

Here’s a simple summary of the financial information you provided:

|

Financial Metric |

Value |

|

Market Cap |

₹ 11.8 Crores |

|

Current Price |

₹ 8.70 |

|

High Price |

₹ 11.60 |

|

Low Price |

₹ 3.20 |

|

Stock P/E |

Not Provided |

|

Book Value |

₹ 27.10 |

|

Dividend Yield |

0.00% |

|

ROCE |

0.25% |

|

ROE |

0.17% |

|

Face Value |

₹ 10.00 |

Quarterly Results

The table data for Sukra Jewellery shows financial performance for three quarters: December 2023, March 2024, and June 2024. In December 2023, the sales were zero, with expenses at Rs. 0.09 crores, leading to a small net loss of Rs. 0.09 crores and an EPS of -0.07. By March 2024, sales significantly increased to Rs. 3.13 crores, but expenses also rose to Rs. 3.00 crores, resulting in a slight operating profit of Rs. 0.13 crores.

Here’s the data for Dec 2023, Mar 2024, and Jun 2024, along with the particulars:

(Rs. in crores)

|

Particulars |

Dec 2023 |

Mar 2024 |

Jun 2024 |

|

Sales |

0.00 |

3.13 |

0.38 |

|

Expenses |

0.09 |

3.00 |

0.39 |

|

Operating Profit |

-0.09 |

0.13 |

-0.01 |

|

OPM (%) |

- |

4.15% |

-2.63% |

|

Other Income |

0.00 |

0.00 |

0.00 |

|

Interest |

0.00 |

0.00 |

0.00 |

|

Depreciation |

0.00 |

0.02 |

0.00 |

|

Profit Before Tax |

-0.09 |

0.11 |

-0.01 |

|

Tax (%) |

0.00% |

0.00% |

0.00% |

|

Net Profit |

-0.09 |

0.11 |

-0.01 |

|

EPS (Rs) |

-0.07 |

0.08 |

-0.01 |

About Sukra Jewellery

Sukra Jewellery, founded in 1979 by Mr. A. Kalkiraju, is a renowned silver retailer based in India. It was the first store in the state to specialize in silver, and it quickly gained fame for its beautiful designs and high-quality silver pieces. Sukra has achieved many notable milestones, including setting two world records for the largest silver sculpture and the largest silver clock. It is also the first silver showroom in India to earn ISO 9001 accreditation and the first in South India to obtain the BIS Silver Hallmarking license.

Sukra offers a wide range of silver jewellery, including contemporary designs, temple jewellery, and antique pieces. Customers can also find unique gift items and pooja articles. With a commitment to quality and creativity, Sukra Jewellery provides stunning pieces that showcase the beauty of silver and gemstones, making it a popular choice for jewellery lovers.

Sukra Jewellery Q1 Results - FAQs

1. What were Sukra Jewellery's total income from operations for Q1 2024?

Sukra Jewellery reported total income from operations of ₹38.00 lakhs for Q1 2024.

2. What caused the decline in sales for Sukra Jewellery in Q1 2024?

The decline in sales for Sukra Jewellery was primarily due to a drop in net sales.

3. How much did Sukra Jewellery's expenses increase in Q1 2024?

Sukra Jewellery's total expenses increased to ₹38.90 lakhs in Q1 2024.

4. What was the loss before tax for Sukra Jewellery in Q1 2024?

Sukra Jewellery faced a loss before tax of ₹0.90 lakhs in Q1 2024.

5. What was Sukra Jewellery's net loss from continuing operations in Q1 2024?

Sukra Jewellery's net loss from continuing operations was ₹0.90 lakhs in Q1 2024.

6. What was the comprehensive income for Sukra Jewellery in Q1 2024?

Sukra Jewellery reported a total comprehensive income of ₹-2.00 lakhs for Q1 2024.

7. What is the current market capitalization of Sukra Jewellery?

Sukra Jewellery has a market capitalization of ₹11.8 crores.

8. Did Sukra Jewellery pay any dividends in Q1 2024?

No, Sukra Jewellery did not offer any dividends, with a yield of 0.00%.

9. What is the return on capital employed (ROCE) for Sukra Jewellery?

Sukra Jewellery has a return on capital employed (ROCE) of 0.25%.

10. What is the return on equity (ROE) for Sukra Jewellery?

Sukra Jewellery's return on equity (ROE) stands at 0.17%.