- Home »

- Quarterly Results »

- West Coast Paper Mills Q1 Results Show Sharp Drop in Profitability

West Coast Paper Mills Q1 Results Show Sharp Drop in Profitability

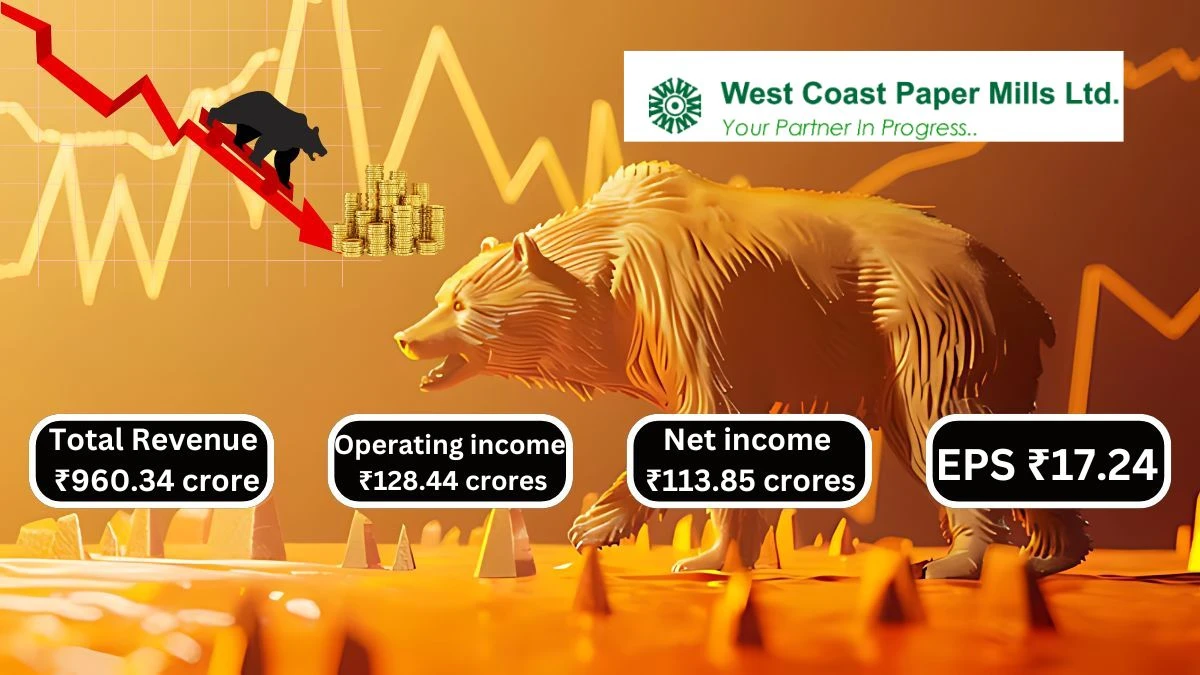

West Coast Paper Mills Q1 Results Reported Total Revenue of ₹960.34 crore, down 29.3% from the previous quarter and 15.7% YoY and Operating income fell to ₹128.44 crores, a decrease of 70.0% QoQ and 63.4% YoY.

by Ruksana

Updated Oct 03, 2024

Table of Content

West Coast Paper Mills Q1 Results: West Coast Paper Mills’ Total revenue for the quarter was ₹960.34 crores, which is down 29.3% compared to the previous quarter (QoQ) of ₹1,357.48 crores. This is also a decrease of 15.7% YoY from ₹1,138.62 crores. Selling, general, and admin expenses increased slightly by 5.5% QoQ but fell 3.5% YoY. Other operating expenses dropped by 23.0% QoQ, indicating better cost management, and increased by only 0.5% YoY.

West Coast Paper Mills’ Operating income showed a big decline of 70.0% QoQ and 63.4% YoY, falling to ₹128.44 crores. Similarly, net income before taxes fell by 63.2% QoQ and 56.9% YoY, reaching ₹163.48 crores. Net income also decreased significantly, down 59.1% QoQ and 53.7% YoY to ₹113.85 crores. This shows that the company is struggling to maintain its profits compared to both the previous quarter and the same quarter last year.

Here are the quarterly results for West Coast Paper Mills for Q1, with a comparison of figures from the previous quarter (Mar 23) and the same quarter last year (Jun 23):

(All figures in crores except per share values)

|

Fiscal Period |

Jun 24 |

Mar 23 |

QoQ Change |

Jun 23 |

YoY Change |

|

Total Revenue |

960.34 |

1,357.48 |

-29.3% |

1,138.62 |

-15.7% |

|

Selling/General/Admin Expenses |

97.60 |

92.99 |

+5.5% |

100.75 |

-3.5% |

|

Depreciation/Amortization |

47.25 |

47.96 |

-1.5% |

43.73 |

+8.0% |

|

Other Operating Expenses |

90.63 |

117.66 |

-23.0% |

90.18 |

+0.5% |

|

Total Operating Expense |

831.89 |

928.31 |

-10.4% |

787.82 |

+5.6% |

|

Operating Income |

128.44 |

429.17 |

-70.0% |

350.79 |

-63.4% |

|

Net Income Before Taxes |

163.48 |

444.45 |

-63.2% |

379.26 |

-56.9% |

|

Net Income |

113.85 |

278.23 |

-59.1% |

245.52 |

-53.7% |

|

Diluted Normalized EPS |

17.24 |

43.81 |

-60.7% |

37.17 |

-53.7% |

Source: Here

For More Q1 Results check our Twitter Page

Visit our website for more Q1 results

West Coast Paper Mills Q1 Results

West Coast Paper Mills reported its unaudited standalone financial results for the quarter ending June 30, 2024. The total income for the quarter was ₹65,870.14 lakhs, which includes revenue from operations at ₹64,181.44 lakhs and other income at ₹1,688.70 lakhs. This total income is lower compared to the previous quarter, which had ₹71,559.86 lakhs. The company’s total expenses for the quarter were ₹53,163.47 lakhs, significantly lower than the previous quarter's ₹60,162.10 lakhs. This reduction in expenses helped increase the profit before tax (PBT) to ₹12,706.67 lakhs, up from ₹11,397.76 lakhs in the previous quarter.

West Coast Paper Mills After accounting for tax expenses of ₹3,395.45 lakhs, the net profit for the quarter was ₹9,311.22 lakhs, which is an increase from ₹8,245.57 lakhs in the previous quarter. The earnings per share (EPS) for this quarter was ₹14.10, which is better than the previous quarter’s ₹12.48. Additionally, the company reported other comprehensive income of ₹973.32 lakhs, bringing the total comprehensive income for the period to ₹10,284.54 lakhs. These results indicate that West Coast Paper Mills is performing well, with increased profits despite a decrease in total income.

Here's a simplified summary of the Unaudited Standalone Financial Results for the Quarter Ended June 30, 2024:

(Rs. in Iakhs)

|

Particulars |

Quarter Ended |

Year Ended |

|

30.06.2024 |

31.03.2024 |

|

|

(Unaudited) |

(Audited) |

|

|

1. Income |

||

|

a) Revenue from operations |

64,181.44 |

70,057.69 |

|

b) Other income |

1,688.70 |

1,502.17 |

|

Total Income |

65,870.14 |

71,559.86 |

|

2. Expenses |

||

|

a) Cost of materials consumed |

36,948.36 |

33,979.77 |

|

b) Purchases of stock-in-trade |

-0.58 |

37.10 |

|

c) Changes in inventories |

-2,944.42 |

2,111.63 |

|

d) Employee benefits expense |

5,660.08 |

5,702.60 |

|

e) Finance costs |

464.28 |

470.72 |

|

f) Depreciation and amortization expense |

2,632.00 |

2,963.92 |

|

g) Other expenses |

10,403.17 |

14,933.46 |

|

Total Expenses |

53,163.47 |

60,162.10 |

|

3. Profit before tax (PBT) |

12,706.67 |

11,397.76 |

|

4. Tax Expense |

||

|

a) Current tax |

3,379.37 |

3,445.73 |

|

b) Less: MAT credit |

- |

138.19 |

|

c) Deferred tax |

16.08 |

-431.73 |

|

Total Tax Expenses |

3,395.45 |

3,152.19 |

|

7. Net Profit after tax |

9,311.22 |

8,245.57 |

|

8. Other Comprehensive Income (OCI) |

||

|

a) Remeasurement of employee benefits |

-135.83 |

-361.12 |

|

b) Remeasurement of equity instruments |

1,201.68 |

754.38 |

|

c) Income tax on OCI |

-92.53 |

38.31 |

|

Total Other Comprehensive Income |

973.32 |

431.57 |

|

10. Total Comprehensive Income |

10,284.54 |

8,677.14 |

|

11. Paid-up Equity Share Capital |

1,320.98 |

1,320.98 |

|

13. Earnings per Share (EPS) |

14.10 |

12.48 |

West Coast Paper Mills Stock Metrics

West Coast Paper Mills is a company that makes paper products. Their market cap is ₹4,025 crore, which shows the total value of the company in the stock market. The current stock price is ₹609, with the highest price being ₹815 and the lowest ₹552 over a specific period. The Price-to-Earnings (P/E) ratio is 7.18, indicating how much investors are willing to pay for each rupee of earnings. The book value is ₹490, meaning the company's assets minus liabilities per share.

Here’s a summary of the provided financial information in a simple format:

|

Parameter |

Value |

|

Market Cap |

₹ 4,025 Cr. |

|

Current Price |

₹ 609 |

|

High / Low |

₹ 815 / ₹ 552 |

|

Stock P/E |

7.18 |

|

Book Value |

₹ 490 |

|

Dividend Yield |

1.32% |

|

ROCE |

29.3% |

|

ROE |

23.8% |

|

Face Value |

₹ 2.00 |

Quarterly Results

The West Coast Paper Mills' quarterly financial results show the company's performance over three months: December 2023, March 2024, and June 2024. In December 2023, the company had sales of 1,045 crores and a net profit of 159 crores. By March 2024, sales slightly increased to 1,070 crores, but the net profit dropped to 130 crores. In June 2024, sales decreased to 960 crores, and net profit fell further to 122 crores.

Here’s the table for the quarterly financial results for December 2023, March 2024, and June 2024:

(Rs. in Crores)

|

Particulars |

Dec 2023 |

Mar 2024 |

Jun 2024 |

|

Sales |

1,045 |

1,070 |

960 |

|

Expenses |

828 |

900 |

785 |

|

Operating Profit |

218 |

170 |

176 |

|

OPM (%) |

21% |

16% |

18% |

|

Other Income |

41 |

59 |

42 |

|

Interest |

6 |

6 |

7 |

|

Depreciation |

46 |

49 |

47 |

|

Profit Before Tax |

207 |

174 |

163 |

|

Tax (%) |

23% |

25% |

26% |

|

Net Profit |

159 |

130 |

122 |

|

EPS (Rs) |

20.58 |

18.14 |

17.24 |

About West Coast Paper Mills

West Coast Paper Mills (WCPM) is a well-known paper manufacturer in India with over 50 years of experience. Located in Dandeli, the company produces a wide variety of high-quality woodfree papers and boards. WCPM focuses on upgrading its technology and processes to ensure that customers receive the best products. The company believes in creativity and innovation, which have helped it become a leader in the paper industry in India and Asia. WCPM is committed to protecting the environment and aims to align its business practices with the need for a cleaner planet.

West Coast Paper Mills operates WESCO Telecom, a subsidiary that produces telecom cables. The management team works hard to support thousands of employees and provide innovative solutions to customers worldwide. WCPM's mission is to achieve customer loyalty by delivering top-quality products suitable for different business segments and people of all ages.

West Coast Paper Mills Q1 Results - FAQs

1. What is the total revenue for West Coast Paper Mills in Q1 2024?

West Coast Paper Mills reported a total revenue of ₹960.34 crores in Q1 2024.

2. How did West Coast Paper Mills’ revenue change compared to the previous quarter?

West Coast Paper Mills' revenue decreased by 29.3% from ₹1,357.48 crores in the previous quarter.

3. What was the YoY revenue change for West Coast Paper Mills?

West Coast Paper Mills experienced a 15.7% decrease in revenue compared to the same quarter last year.

4. What are the selling, general, and administrative expenses for West Coast Paper Mills in Q1 2024?

West Coast Paper Mills reported selling, general, and administrative expenses of ₹97.60 crores in Q1 2024.

5. Did West Coast Paper Mills improve its operating expenses in Q1 2024?

Yes, West Coast Paper Mills' other operating expenses dropped by 23.0% in Q1 2024.

6. What was the operating income for West Coast Paper Mills in Q1 2024?

West Coast Paper Mills' operating income fell to ₹128.44 crores in Q1 2024.

7. How did net income before taxes change for West Coast Paper Mills?

Net income before taxes for West Coast Paper Mills decreased by 63.2% in Q1 2024.

8. What is the net income reported by West Coast Paper Mills for Q1 2024?

West Coast Paper Mills reported a net income of ₹113.85 crores for Q1 2024.

9. What was West Coast Paper Mills' profit before tax in Q1 2024?

West Coast Paper Mills reported a profit before tax of ₹12,706.67 lakhs for the quarter.

10. What is the market capitalization of West Coast Paper Mills?

The market capitalization of West Coast Paper Mills is ₹4,025 crores.