- Home »

- Credit Card »

- Hilton Credit Cards Comparison: Choose the Right One for You

Hilton Credit Cards Comparison: Choose the Right One for You

Hilton Credit Cards Comparison: Find your perfect match among Hilton's co-branded cards and then choose the one that suits your travel and spending needs.

by Kowsalya

Updated Nov 17, 2023

On This Page

Hilton Credit Card

Hilton offers a range of co-branded credit cards designed to enhance your travel experience and provide valuable rewards when staying at Hilton properties. These credit cards are issued in partnership with American Express and cater to various preferences and spending habits. Here's a brief overview of the types of Hilton credit cards available:

Hilton Honors

The Hilton Honors credit card is a no-annual-fee option that grants users accelerated points on Hilton purchases and various everyday spending categories. ith perks like complimentary Silver Status, no foreign transaction fees, and an upgrade path to Gold Status, it's a versatile choice for Hilton enthusiasts.

- Annual Fee: $0

- Welcome Offer: 100,000 Points

- Key Benefits:

- 7X Points on Hilton purchases

- 5X Points at U.S. restaurants, gas stations, and supermarkets

- 3X Points on other eligible purchases

- Silver Status (complimentary)

- No foreign transaction fees

- Upgrade to Gold Status with $20,000 spend

Hilton Honors Surpass®

For a $150 annual fee, the Hilton Honors Surpass® card, featuring exclusive Hilton Honors American Express Surpass Card benefits, offers enhanced benefits with higher points multipliers on Hilton and U.S. restaurant, gas, and supermarket purchases. It provides complimentary Gold Status, a potential upgrade to Diamond Status, and a Free Night Reward after reaching spending thresholds, making it particularly appealing for frequent travelers seeking elevated perks.

- Annual Fee: $150

- Welcome Offer: 170,000 Points

- Key Benefits:

- 12X Points on Hilton purchases

- 6X Points at U.S. restaurants, gas stations, and supermarkets

- 4X Points on U.S. online retail

- 3X Points on other eligible purchases

- Gold Status (complimentary)

- No foreign transaction fees

- Upgrade to Diamond Status with $40,000 spend

- Free Night Reward after $15,000 in purchases

Hilton Honors Aspire

Tailored for luxury travelers, the Hilton Honors American Express Aspire card, featuring exclusive American Express Aspire Card benefits, comes with a $550 annual fee. This premium card offers substantial rewards, including 14X points on Hilton purchases, complimentary Diamond Status, up to three Free Night Rewards annually, and various travel credits. It caters to individuals seeking not only elevated benefits but also exclusive experiences in their journeys.

- Annual Fee: $550

- Welcome Offer: 180,000 Points

- Key Benefits:

- 14X Points on Hilton purchases

- 7X Points on flights, car rentals, and U.S. restaurants

- 3X Points on other eligible purchases

- Diamond Status (complimentary)

- No foreign transaction fees

- Up to 3 Free Night Rewards annually

- Up to $200 Hilton Resort credits

- Various travel perks and credits

Hilton Honors Business

The Hilton Honors Business credit card, with a $95 annual fee, is ideal for businesses and frequent travelers. It offers generous points multipliers on Hilton and various business-related expenses, complimentary Gold Status, Free Night Rewards based on spending, and Priority Pass™ Select membership for lounge access, enhancing both business and leisure travel.

- Annual Fee: $95

- Welcome Offer: 130,000 Points

- Key Benefits:

- 12X Points on Hilton purchases

- 6X Points at U.S. gas stations, restaurants, wireless services, shipping, flights, and car rentals

- 3X Points on other eligible purchases

- Gold Status (complimentary)

- No foreign transaction fees

- Free Night Reward after $15,000 in purchases

- Additional Free Night Reward with $60,000 in purchases

- Priority Pass™ Select membership with 10 lounge visits

Hilton Honors Credit Cards Comparison

Hilton offers a range of co-branded credit cards, each tailored to different preferences and travel needs. To help you choose the right one, we've put together a comparison of the key features, including annual fees, welcome offers, elite status benefits, free night certificates, and earning rates. Explore the options below to find the Hilton Honors credit card that aligns best with your travel and financial goals:

| Card | Annual Fee | Welcome Offer | Bonus Points | Built-In Benefits |

|---|---|---|---|---|

| Hilton Honors | $0 | 100,000 Points | 7X Hilton, 5X U.S. restaurants/gas/supermarkets, 3X other | Silver Status, No foreign transaction fees, Upgrade to Gold with $20,000 spend |

| Hilton Honors Surpass® | $150 | 170,000 Points | 12X Hilton, 6X U.S. restaurants/gas/supermarkets, 4X U.S. online retail, 3X other | Gold Status, No foreign transaction fees, Upgrade to Diamond with $40,000 spent, Free Night after $15,000 |

| Hilton Honors Aspire | $550 | 180,000 Points | 14X Hilton, 7X flights/car rentals/U.S. restaurants, 3X other | Diamond Status, No foreign transaction fees, Up to 3 Free Night Rewards annually, Up to $200 Hilton Resort credits, Various travel perks and credits |

| Hilton Honors Business | $95 | 130,000 Points | 12X Hilton, 6X U.S. gas/restaurants/wireless/shipping/flights/car rentals, 3X other | Gold Status, No foreign transaction fees, Free Night after $15,000, Additional Free Night with $60,000, Priority Pass™ Select with 10 lounge visits |

MarketsHost presents an all-encompassing exploration of Credit Cards, offering an exclusive gateway to the realm of smart financial management and secure transactions.

Hilton Honors Credit Card Login

The Hilton Honors American Express Credit Card login process is a secure gateway that allows cardholders to access their account information, manage their card benefits, and monitor their rewards

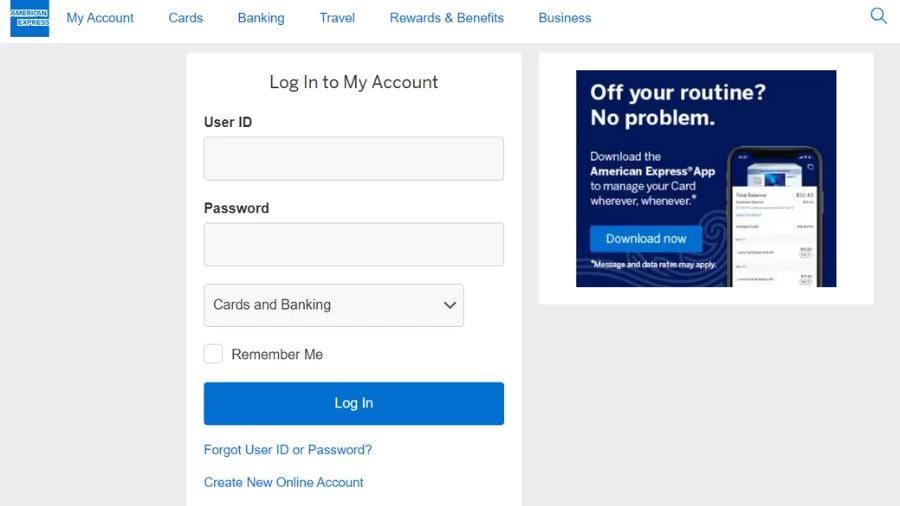

- To log in to your Hilton Honors American Express Credit Card account, you will need to visit the American Express website.

- Once you are on the American Express homepage, you should look for the "Log In to My Account" section.

- In the "Log In to My Account" section, you will be prompted to enter your User ID and Password. Your User ID and Password are the credentials you set up when you initially registered for your Hilton Honors American Express Credit Card account.

- You can check the "Remember Me" box if you want the website to remember your login credentials for future visits. However, it's recommended to only use this option on secure, personal devices.

- After entering your User ID and Password, click on the "Log In" button to access your Hilton Honors American Express Credit Card account.

How to Apply Hilton Honors Credit Card?

Apply for a Hilton Honors American Express card effortlessly by following these simple steps on the Hilton website. Here's a detailed guide on how to apply for a Hilton Honors American Express card:

Visit the Hilton Website

Go to the official Hilton website by typing www.hilton.com into your web browser.

Navigate to Offers

Once on the Hilton homepage, locate and click on the 'Offers' tab at the top of the page. This will take you to a separate page showcasing current offers and deals.

Select the Hilton Honors Card

On the offers page, look for the section related to the Hilton Honors Card. There, you may find information about different types of cards and the rewards they offer.

Explore Card Details

Under the 'Hilton Honors Card' section, select 'More Details' to explore the specifics of each card, including the benefits and rewards associated with them. This will help you compare the available options.

Choose a Card

After reviewing the details of each card, choose the Hilton Honors American Express card that best suits your preferences and needs.

Click 'Apply Now'

Once you've made your decision, click on the 'Apply Now' button associated with the chosen card. This will initiate the application process.

Complete the Application Form

You will be directed to a secure page where you need to fill out the online application form. Provide accurate and complete information, including personal details, financial information, and any other required information.

Review Terms and Conditions

Before submitting your application, take the time to review the terms and conditions associated with the Hilton Honors American Express card. This information includes details about fees, interest rates, and other important terms.

Submit Your Application

Once you are satisfied with the terms and have filled in all the required information, submit your application. You may be asked to review your application one final time before confirming.

Hilton Honors Points Value

The value of Hilton Honors points is approximately 0.6 cents each, according to recent valuations from Bankrate. The program, with over 6,200 properties globally, offers a flexible redemption system where free night awards start at 5,000 points and go up to 95,000 points for a standard room. The actual worth of points can vary based on factors like travel dates, the specific Hilton property, and your flexibility with plans.

To maximize the value, consider booking standard rooms in high-end luxury properties, taking advantage of the 5th-night free benefit, and being flexible with travel dates. Additionally, Hilton Honors points can be transferred to various airline and rail partners, offering added versatility to the program.

Hilton Credit Card Authorization Form

The Hilton Credit Card Authorization Form is a document used for making reservations at Hilton hotels. It allows a credit card holder to secure a reservation for a guest. The form provides necessary details for processing payments and charges associated with the guest's stay. It ensures that the cardholder agrees to cover specific expenses and authorizes the hotel to charge their credit card accordingly.

Instructions for Completing the Form

Step 1 - Obtain the Form

The form can be acquired in either PDF or Word format. It is essential to have the correct and up-to-date version of the form for accuracy. Click here to get the Hilton Credit Card Authorization Form

Step 2 - Contact Hilton Property

Before filling out the form, you need to contact the specific Hilton property where you plan to make a reservation. During this call, you will need to obtain the following information:

- Reservation Number for your Guest.

- Fax Number for the hotel.

- The department or individual to whom the completed form should be faxed.

Step 3 - Enter the Date

Write the current date on the form to indicate when the authorization is being issued.

Step 4 - Cardholder Information

- Cardholder Name as it Appears on Credit Card: Enter the full name of the individual whose name is on the credit card. The name must match the card exactly.

- Cardholder Billing Address: Provide the billing address as it appears on the credit card statement, including street address, city, state, and zip code.

Step 5 - Contact Information

- Daytime/Business Telephone: Enter the cardholder's daytime or business telephone number.

- Evening Telephone: Enter the cardholder's evening telephone number.

Step 6 - Credit Card Details

- Credit Card Number: Enter the full credit card number.

- Expiration Date: Enter the expiration date of the credit card (Month/Year).

Step 7 - Card Type

Check the appropriate box to specify the type of credit card being used (Visa, MasterCard, American Express, Discover, JCB, or Diner's Club).

Step 8 - Bank Information

- Credit Card Issuing Bank Name: Enter the name of the bank that issued the credit card.

- Bank Security Number (from the back of your credit card): Enter the three-digit security code from the back of the credit card (often found in the signature box).

Step 9 - Charges to Cover

Check the boxes next to the categories of charges you agree to cover on behalf of the guest. This may include all charges, room and tax, food and beverage, retail, and recreation expenses.

Step 10 - Maximum Amount

Specify the maximum dollar amount up to which you are willing to cover the guest's expenses.

Step 11 - Amount to Be Charged

Enter the specific amount that should be immediately charged to the credit card for room and taxes or as a deposit.

Step 12 - Cardholder Signature and Date

- Cardholder Signature: The cardholder must physically sign their name on the form.

- Date: Enter the date on which the cardholder signs the form (Month/Day/Year).

Step 13 - Submission Guidelines

Ensure that you follow the submission guidelines provided by the specific Hilton property to which you are submitting the form. Comply with any additional requirements, such as additional paperwork or documentation.

Hilton Credit Cards Comparison - FAQs

1. What is the Hilton Honors program?

The Hilton Honors program is a loyalty program offered by Hilton that allows members to earn points for stays at Hilton properties and redeem them for various rewards, including free nights, upgrades, and more.

2. Can I earn Hilton Honors Bonus Points with everyday purchases using these credit cards?

Yes, on dining, groceries, and more, depending on the card.

3. How do I redeem Hilton Honors points for hotel stays?

Log in, select hotel, and choose pay with points during booking.

4. Do Hilton Honors Bonus Points expire?

No, if there's account activity every 12 months.