How to Close the Chase Checking Account?

Chase Checking Account can be closed by visiting a branch, using online banking, calling 1-800-935-9935, or mailing a closure request.

by Sai V

Updated Sep 04, 2023

On This Page

- How to Close the Chase Checking Account?

- What to Do Before Closing a Chase Account?

- Is There a Fee for Closing My Chase Checking Account?

- How to Close Chase Checking Accounts Online?

- Can I Close a Checking Account on the Chase App?

- Can I Close My Chase Account and Open Another One?

- Does Closing a Chase Credit Card Influence Your Credit Score?

- What is the Procedure for Opening an Account at Chase Bank?

- Are Accounts at Chase Automatically Closed by the Bank?

How to Close the Chase Checking Account?

To close a Chase checking account, you can visit a nearby branch, use their online platform, call 1-800-935-9935, or send a closure request by mail. Each method requires different steps, so choose the one that suits you best.Closing a Chase Checking Account can be done through several methods to suit your preferences and circumstances. Below are the steps for closing your Chase Checking Account:

Visit a Local Chase Bank:

- Â Â Â Locate the nearest physical Chase bank branch in your area.

- Â Â Â Ensure you have the necessary identification and account details ready, including your ID, social security number, PIN, and address details.

- Â Â Â Visit the bank and speak to a bank teller.

- Â Â Â Inform the bank teller that you wish to close your Chase Checking Account.

- Â Â Â Provide the required proof of identity and account ownership.

- Â Â Â Once verified, your account will be closed immediately, and you will receive confirmation.

Online Account Closure:

- Â Â Â Access the official Chase website using a computer or smartphone.

- Â Â Â Navigate to the Chase website and log in to your account.

- Â Â Â Schedule a meeting with a Chase representative online or send them a message explaining your intention to close your Checking Account.

- Â Â Â Expect a phone call or a reply within two days from a Chase representative.

- Â Â Â During this process, be prepared to confirm your identity to ensure account security.

- Â Â Â Once the closure is confirmed, your Chase Checking Account will be closed.

Closing via Phone Call:

- Â Â Â Dial the Chase customer service number at 1-800-935-9935.

- Â Â Â Have all the relevant account details, such as your account number and personal information, readily available.

- Â Â Â When a bank teller or representative answers, inform them that you want to close your Chase Checking Account.

- Â Â Â Answer any questions they ask to confirm your identity and account details.

- Â Â Â If the provided information is accurate, your account will be closed within 24 hours.

Mail-In Account Closure:

- Â Â Â If the previous methods are not suitable for you, you can opt to send a physical letter to Chase to close your Checking Account.

- Â Â Â Visit the Chase website to find a closing form, which you should fill out with the necessary information.

- Â Â Â If there is a balance in your Checking Account, make sure to mention it on the form.

- Â Â Â Once you have completed the form, mail it to the following address: National Bank By Mail, P.O. Box 36520, Louisville, KY 40233-6520.

- Â Â Â Await confirmation from Chase that your account has been closed.

What to Do Before Closing a Chase Account?

Before you consider closing your Chase account, it's crucial to be well-prepared and take several important steps to ensure a smooth transition. From securing a new account and transferring balances to reviewing recurrent charges and redirecting your salary, careful planning can help you avoid potential complications and protect your financial well-being during the account closure process.

Establish a Replacement Account: Ensure you have another checking account ready to use before closing your Chase account. Stick with your existing alternative account if you have one, or open a new one if you're changing banks.

Move Any Remaining Balance: Move any remaining funds from your Chase checking account to your new account a few days before closing the Chase account to allow for processing time.

Examine Recurring Charges: Examine your monthly statement for recurring charges such as utility bills or rent. Transfer these charges to your new account at least 15 days before they are due. Don't overlook semi-annual recurring charges that may not be on your monthly statement.

Update Subscription Payment Methods: If you have subscriptions (e.g., Netflix, Spotify, Apple Music) linked to your Chase account, update the payment information to your new account to avoid service interruptions.

Redirect Salary Deposits: If your salary is directly deposited into your Chase account, arrange for it to be redirected to your new account. Make this transfer at least one week before your next expected paycheck.

Address Outstanding Bank Fees: Scrutinize your Chase account for any outstanding or late bank fees and resolve them promptly. Addressing these fees is vital to safeguard your credit score, especially if you plan to apply for loans in the future.

Is There a Fee for Closing My Chase Checking Account?

No, there is typically no fee for closing your Chase checking account. Chase allows customers to close their accounts without charging a specific fee for the account closure itself. However, it's important to ensure that your account is in good standing, meaning it doesn't have a negative balance or any unresolved fees, before initiating the closure process.

If your account does have a negative balance or outstanding fees, you will need to deposit funds to bring the balance to zero before closing it. While the account closure itself is usually free, it's important to be aware of potential fees related to other financial transactions, such as transferring remaining funds or redirecting automatic payments to a new account.

If you're considering closing your Chase checking account due to concerns about fees or account terms, it's advisable to explore alternative options within Chase, such as switching to a different type of account that may have lower fees or contacting Chase's customer service to discuss your specific issues. This proactive approach can help you make an informed decision about whether closing your account is the best course of action for your financial needs.

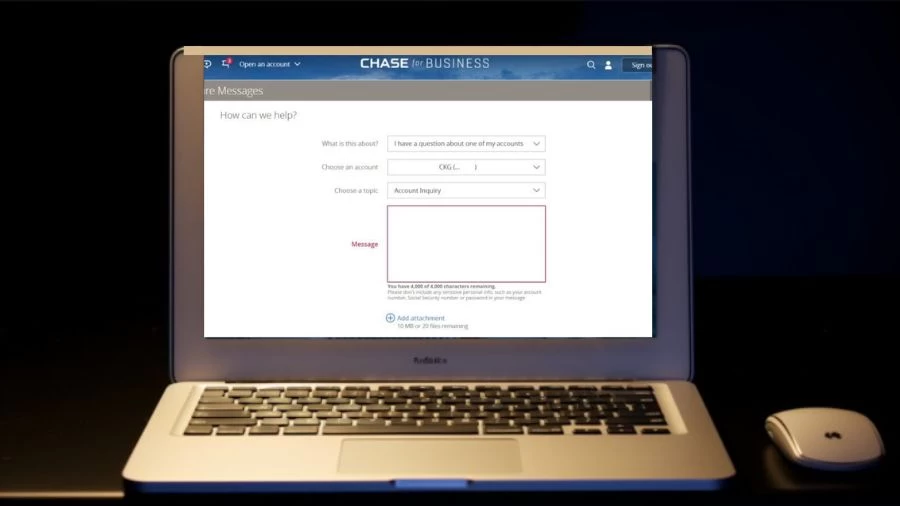

How to Close Chase Checking Accounts Online?

To close a Chase Checking Account online, the most convenient method is to access the Chase online banking website, where you can use the Secure Message Center to send an account closure request via email. Within approximately 2 working days, you should receive a response, which may include follow-up questions and confirmation of the account closure. This method offers a simple and efficient way to initiate the account closure process from the comfort of your own home.

Log In to Your Chase Account:

- Â Â Â Start by visiting the Chase online banking website.

- Â Â Â Log in to your Chase account using your username and password. If you haven't enrolled in online banking, you'll need to do so first.

Navigate to the Secure Message Center:

- Â Â Â After logging in, look for the Secure Message Center. This is typically located within your online banking dashboard or menu options.

Compose an Account Closure Request:

- Â Â Â Within the Secure Message Center, you'll have the option to send a secure message or email to Chase's customer service team.

- Â Â Â Compose a message stating your intention to close your Chase checking account. Be clear and concise in your request.

Provide Necessary Information:

- Â Â Â In your message, it's essential to include details such as your account number, the type of account you want to close (checking), and any specific instructions or questions you may have regarding the closure.

Submit the Request:

- Â Â Â Once you have filled out all the necessary information and confirmed your request, send the message.

Wait for Chase's Response:

- Â Â Â Chase's customer service team will typically respond to your closure request within 2 working days.

- Â Â Â They may ask for additional information or clarification to process your request efficiently.

Follow-Up and Confirmation:

- Â Â Â Keep an eye on your secure message center or email inbox for Chase's response.

- Â Â Â If they require more information, respond promptly.

- Â Â Â Once they have all the necessary details, they will confirm the closure of your Chase checking account.

Can I Close a Checking Account on the Chase App?

Closing a Chase checking account cannot typically be done directly through the Chase mobile app. To close your Chase checking account, you'll need to log into your Chase online account via a web browser and access the Secure Message Center as outlined in the previous instructions. From there, you can initiate the account closure process by sending a message to Chase expressing your intent to close the account.

Chase usually responds within 2 business days and provides you with the necessary instructions to complete the closure. While the Chase app is a convenient tool for managing your account, certain sensitive account actions, like closing an account, often require additional security measures and communication that are better facilitated through the online banking platform.

Can I Close My Chase Account and Open Another One?

Closing a Chase account and opening a new one is possible, but it's important to understand that once you close an existing Chase credit card account, you cannot reopen the same account. However, you can apply for a different Chase credit card, including the one you had previously.

Chase does have certain rules that may affect your eligibility, such as the 5/24 rule, which limits approvals for individuals who have opened five or more credit cards from any issuer within the last 24 months. Additionally, specific Chase card families, like the Sapphire cards, have their own eligibility criteria, including waiting periods for receiving new cardmember bonuses.

Does Closing a Chase Credit Card Influence Your Credit Score?

Closing a Chase credit card can have an impact on your credit score, though it's important to note that it's not always a straightforward effect. When you close a credit card account, it can potentially affect your credit score in a few ways. First, it can reduce your available credit limit, which may increase your credit utilization ratio if you carry balances on other credit cards.

A higher credit utilization ratio can negatively impact your credit score. Additionally, closing an older credit card account can shorten your average credit history length, which can also have a slight negative impact. However, if closing the card helps you manage your finances better and avoid accumulating debt, the long-term benefits may outweigh the temporary dip in your credit score. It's crucial to carefully consider your financial situation and priorities before deciding to close a credit card account.

What is the Procedure for Opening an Account at Chase Bank?

Decide on the Type of Account You Want:

Before you begin the account opening process, determine the type of account you wish to open. Chase Bank offers various options, including checking accounts, savings accounts, credit cards, and loans. Choose the one that best suits your financial needs.

Online Application:

If you prefer the convenience of applying from the comfort of your home, follow these steps for an online application:

- Go to the Chase Bank website(www.chase.com).

- Select the specific type of account you want to open, whether it's a checking account, savings account, or a credit card.

- Provide your personal information, including your full name, address, and social security number.

- Additionally, you may be asked to disclose details about your employment status and income.

- Follow the prompts on the website to complete the online application.

Phone Application:

If you prefer to open an account over the phone, you can reach Chase customer service at 1-800-935-9935. Here's what to expect:

- A friendly representative will assist you in providing the necessary information and guide you through the account opening process.

- Be prepared to answer questions regarding your personal and financial details.

- The representative will ensure all required information is collected accurately.

In-Person Application:

For those who prefer a face-to-face interaction, you can choose to visit a Chase Bank branch near your location. Follow these steps for an in-person application:

- Bring a government-issued ID, such as a driver's license or passport.

- Ensure you have any additional documents required for the account type you're opening, such as your social security card.

- When you arrive at the branch, a bank representative will assist you with the account opening process and address any questions or concerns you may have.

Account Setup and Confirmation:

Once your application is approved, whether submitted online, by phone, or in person, you will receive a confirmation indicating that your new Chase account has been successfully created. This confirmation is your assurance that your account is active and ready for use.

Are Accounts at Chase Automatically Closed by the Bank?

Chase does not have a publicly disclosed policy for automatically closing accounts, but they retain the authority to close an account as stated in Section VIII of their Deposit Account Agreement. This closure typically occurs when account holders violate the terms and conditions of their checking account agreement. While there have been reports of account closures, particularly among businesses in specific industries like adult entertainment, Chase has denied these claims. In general, accounts are closed due to inactivity, illegal activities, or a negative balance. To avoid unexpected account closures, it's crucial for customers to adhere to the terms outlined in their account agreements.

How to Close the Chase Checking Account - FAQs

1. How do I open an account at Chase Bank?

You can open a Chase account online through their website, by phone, or in person at a branch.

2. What documents do I need to open a Chase account in person?

You'll typically need a government-issued ID (like a driver's license or passport) and any required documents based on the account type.

3. Can Chase automatically close my account?

Chase does not have an automatic closure policy, but they can close accounts for violations of their account agreements.

4. How can I close my Chase account?

To close your Chase account, follow the specific instructions provided by Chase, which may involve contacting customer service or visiting a branch.

5. Will closing a Chase account affect my credit score?

Closing a Chase account may have a slight negative impact on your credit score, so consider your financial situation before closing it.