- Home »

- Credit Card »

- Reflex Credit Card Login, Customer Service and Payment

Reflex Credit Card Login, Customer Service and Payment

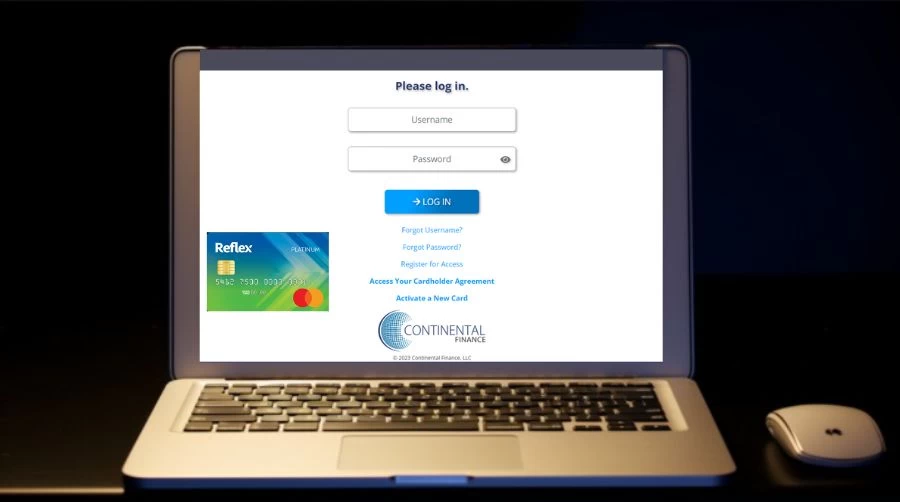

To access your Reflex Platinum Mastercard account, visit the Reflex credit card login page on the Continental Finance website, and input your username and password. Click on "Login to My Account" to enter your online account.

Updated Oct 04, 2023

On This Page

Reflex Credit Card Login

Continental Finance Company, or CFC, is a company that focuses on customer satisfaction. They have managed over 2.6 million credit cards since they started and prioritize their customers. They offer credit cards that are designed to assist people in building or improving their credit in a respectful manner. If you have less-than-perfect credit, one of their brand cards can be a helpful tool to rebuild your credit history.

To log in to your Reflex Platinum Mastercard account, follow these steps:

- Visit the Reflex credit card login page on the Continental Finance website.

- Enter your username and password in the respective fields.

- Click on "Login to My Account" to access your online account.

Once you've successfully logged in, you can manage your Reflex card account online. This includes tasks like paying your credit card bill, viewing statements, monitoring account activity, and updating account information such as passwords and automatic payments.

If you ever forget your login information, you can easily retrieve it by clicking on "Forgot Username or Password?" on the Continental Finance login page and following the provided prompts for username or password recovery.

How to Apply for a Reflex Credit Card?

Applying for a credit card is a straightforward process that allows individuals to access a line of credit for various financial needs. Whether you're looking to establish or rebuild your credit history, earn rewards, or enjoy cardholder benefits, applying for a credit card involves several key steps. To apply for a Reflex credit card, follow these steps:

- Visit the official website at www.reflexcardinfo.com.

- Click on the "Apply Now" button located in the top right corner of the homepage. If you received an offer in the mail, you can click on "Respond to Mail Offer" instead.

- Complete the pre-qualification form with your personal details, including your name, address, email, phone number, social security number, date of birth, and income. You can also opt to receive electronic statements and offers from the issuer.

- Carefully review the terms and conditions of the card, and check the box to agree to them. You can also access information on rates, fees, costs, and card limitations by clicking on the provided link.

- Click on the "See My Card Offers" button to submit your form and check if you pre-qualify for the card. This step won't impact your credit score.

- If you pre-qualify, you'll see one or more card offers tailored to your credit profile. Review the details of each offer and select the one that best suits your needs. You can also decline all offers if none are suitable.

- If you accept an offer, you'll be asked to provide additional information to complete your application. You'll also need to verify your identity and consent to a hard credit inquiry, which may affect your credit score.

Once you submit your application, you'll receive an instant decision on whether you're approved or not. If approved, you can expect to receive your card by mail within 7 to 10 business days. You'll need to activate the card and set up an online account before using it.

Reflex Credit Card Customer Service

If you have any concerns or inquiries related to your Reflex Credit Card, they are here to assist you with any issues or questions you may have regarding your Reflex Credit Card.

Here's how you can reach their customer service:

Lost or Stolen Card: In case your card is lost or stolen, call 1-800-556-5678 immediately.

General Customer Service: For any questions or assistance, you can call Customer Service at 1-866-449-4514 during the following hours: Monday to Friday, from 7 a.m. to 12 a.m. Eastern Time, and Saturday/Sunday, from 8 a.m. to 8 p.m. Eastern Time.

Automated Account Information: To access automated account information, call 1-866-449-4514, and this service is available 24 hours a day, 7 days a week.

Payments: If you need to make a payment, call 1-800-518-6142 during these hours: Monday to Friday, from 7 a.m. to 12 a.m. Eastern Time, and Saturday/Sunday, from 8 a.m. to 8 p.m. Eastern Time.

For any written inquiries, you can use the following mailing addresses:

General Inquiries: Reflex Card, P.O. Box 3220, Buffalo, NY 14240-3220.

Funding of Security Deposit: Reflex Card, P.O. Box 8099, Newark, DE 19714-8099.

Payments on Account: Reflex Card, P.O. Box 6812, Carol Stream, IL 60197-6812.

Join us at MarketsHost for a journey to financial expertise. Explore and reach new heights.

Reflex Credit Card Payment

When it comes to managing your Reflex Credit Card, one of the essential tasks is making timely payments to keep your account in good standing. Making payments on your Reflex Credit Card is a straightforward process and offers several convenient options to ensure you never miss a due date. Paying your Reflex Credit Card bill is convenient and can be done in various ways:

Online: Log in to your account using your credentials and make a payment through the official website.

Mobile App: You can use the mobile app designed for iOS and Android to make payments.

Over the Phone: If you prefer to make payments over the phone, call customer service at (800) 518-6142.

Via Mail: Send a check or money order (no cash) to the following address at least 5-7 business days before your due date to ensure timely arrival,

- Reflex Card, P.O. Box 6812, Carol Stream, IL 60197-6812

Please note that mail payments take longer to process, approximately 5-7 business days, while online and phone payments typically post within 1-3 business days.

What Credit Score is Needed for a Reflex Credit Card?

To qualify for a Reflex Credit Card, you generally need a credit score in the range of 300 to 719, which encompasses a spectrum from poor to good credit. Unlike some other credit cards, the Reflex Credit Card is designed to cater to individuals who may be working on building or improving their credit history.

Keep in mind that your specific approval may also depend on other factors such as your income and financial history, so it's advisable to apply and see if you pre-qualify. Additionally, if you're looking to compare credit card options, you can use your free credit score to help determine which card is the right fit for your financial situation.

Reflex Credit Card Pre-Approval

When considering applying for a credit card like the Reflex Credit Card, it's often a good idea to check if you're pre-approved before formally submitting an application. To check if you're pre-approved for a Reflex Credit Card, follow these steps:

- Fill out the pre-qualification form with your personal information, including your name, address, contact details, social security number, date of birth, and income. You can also opt to receive electronic statements and offers from the issuer.

- Review the card's terms and conditions and agree to them. You can also access information about rates, fees, costs, and card limitations.

- Click the "See My Card Offers" button to submit your form and determine if you pre-qualify for the card. This step won't affect your credit score.

- If you pre-qualify, you'll see one or more card offers that match your credit profile. Review these offers and select the one that suits your needs. You can decline all offers if none are of interest.

- If you accept an offer, provide additional information to complete your application. You'll need to verify your identity and agree to a hard credit inquiry, which may impact your credit score.

- Expect an instant decision on your application. If approved, your card will arrive by mail within 7 to 10 business days. Remember to activate your card and create an online account before using it.

Reflex Credit Card Annual Fee

The Reflex Mastercard comes with an annual fee ranging from $75 to $125. This card is designed for individuals with bad credit, but it's important to note that it's relatively expensive and offers limited benefits. There may be better credit card options available, so it's worth considering your choices carefully.

How Can I Get Reflex Credit Card Without Annual Fee?

Unfortunately, there is no option for obtaining a Reflex Credit Card without an annual fee. This card is primarily targeted at individuals with limited or bad credit, and it typically comes with a high annual fee.

While it can help improve your credit score by reporting to the major credit bureaus, it's important to consider the costs associated with this card, such as the annual fee and high APR. There may be better credit card options available for those looking to build or rebuild their credit without the burden of an annual fee.

Reflex Credit Card Login - FAQs

1. How can I log in to my Reflex Credit Card account?

You can log in to your account by visiting the official website and entering your credentials.

2. What should I do if I forget my username or password?

Click on "Forgot Username or Password?" on the login page and follow the prompts to retrieve or reset your login information.

3. Is there a mobile app for Reflex Credit Card login?

Yes, there is a mobile app available for both iOS and Android devices.

4. How long does it take for online payments to post to my account?

Online payments typically take 1-3 business days to post.

5. Can I make payments over the phone?

Yes, you can make payments over the phone by calling customer service at (800) 518-6142.